Ukraine conflict briefing

Powered by

Download GlobalData’s Ukraine conflict executive report

- ECONOMIC IMPACT -

Latest update: 29 July

2.9%

The World Bank has lowered its global growth forecast from 4.1% to 2.9%, with a warning that many countries may see recessions.

3.3%

GlobalData forecasts that the world economy will grow at just 3.3% in 2022 following 5.9% growth in 2021.

The conflict continues to create major uncertainties for global food supplies. After a period of easing, prices of grains and oilseeds have begun to escalate again as several other exporting countries have introduced schemes to limit exports and preserve domestic supplies.

Even after a possible end to the conflict, there are significant downside risks to Ukraine’s current 2022/23 grain and oilseed crops, and a lack of supplies such as fertiliser will reduce yields from spring and, most likely, next year’s winter crops.

- UKRAINE CRISIS OVERVIEW -

Latest update: 29 July

3 million

Ukraine is seeking to export three million tonnes of grain stocks from its Black Sea ports each month.

5 months

The Ukraine-Russia war has passed the five-month mark, following the 24 February invasion.

Ukraine is seeking to restart exports of grain following the signing of a UN-backed agreement with Russia, which will be overseen by NATO member Turkey. The loss of Ukrainian grain on the world market has created a global shortage and threatens to plunge many countries into food poverty. The waters around Ukraine’s ports have been heavily mined to prevent an invasion by sea, and also to prevent a breakout by Ukraine’s naval assets from breaking out.

More than five months into the war, Russia has prioritised the seizing of the Donbas region, where it is likely hasty elections will be organized by pro-Russian figures installed in occupied region. Ukraine is attempting to conduct a counterattack in the south of the country near the city of Kherson utilizing western-supplied equipment to strike at key infrastructure to isolate Russian forces.

- IMPACT ON COMMODITY MARKETS -

Latest update: 24 March

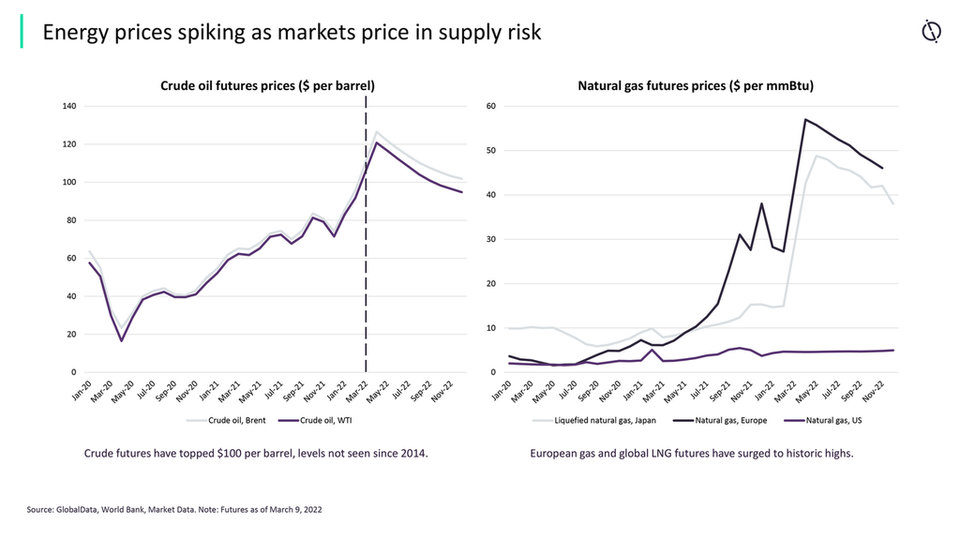

Energy prices spike as markets price in supply risk

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Latest update: 29 July

Supply chain and demand disruption

Although relatively small economies by global standards, Ukraine and Russia are substantial exporters of platinum, aluminium, titanium, nickel, cobalt, lithium, neon, xenon and palladium used in civil and military aerospace and defence electronics.

Defence OEMs have in recent weeks spoken of the difficulties experienced in the global supply chain, with the Ukraine war exacerbating the fallout from the Covid-19 pandemic. The substantial Ukrainian aerospace industry, one of the largest in the world, faces short-term annihilation.

Impact of sanctions

Russia has attempted to limit the impact of western sanctions following its invasion of Ukraine, seeking to leverage existing partnerships with countries such as Iran, Turkey, China, and Belarus.

The ability of the Russian state to finance and develop next generation defence platforms will be hit hard and will impact prospects in growth export markets in the Middle East.

Dependent existing importers of Russian hardware, such as India, stand to be impacted by more stringent application of US CAATSA regulations, likely impacting the S-400 SAM and stealth frigate procurements.

Potential Russian counter-sanctions on titanium would impact the global aerospace industry. Global stockpiles have been bought up and supply constraints past 2023 would have a large impact on production.

New research from the Yale School of Management, as reported by Investment Monitor, states that Russia is heading for “economic oblivion” with widespread outflows of capital from Russian elites as western and allied business interests all but cease operations in the country.

Industry predictions

While NATO member governments have been quick to speak of the need to boost defence spending to counter the threat of Russia, the promised uptick in financial muscle is yet to be felt.

Companies, such as Sweden’s Saab, are monitoring the situation and working with customers to ensure that production is able to meet demand, particularly high in areas such as ammunitions and tactical weapon systems.

An increase of defence spending closer to the NATO-agreed target of 2% across Europe would result in spending approximately a third higher than current.

The applications of Finland and Sweden to join NATO are being ratified by the member states, with more than half so far having approved the process.

Along with Germany's significant €100bn defence spending increase, Poland, Romania, Sweden, Denmark, and China have all announced defence budget increases while France and Canada are considering doing so. The situation in the UK will become clearer once the new Prime Minister has been selected, with the two remaining candidates having differing perspectives on defence spending.