Feature

MBT 2.0: heavy armour evolution

Far from being cast into obsolescence in the brutal lethality of the modern battlefield, main battle tanks are evolving to meet the threats. Gordon Arthur reports.

The Leopard 2 A-RC 3.0 demonstrator MBT from KNDS, replete with a 130mm L/51 main gun fitted in an uncrewed turret. Credit: KNDS

After the Cold War ended, some postulated that the day of the main battle tank (MBT) had passed. Latterly, others speculated that loitering munitions and drone proliferation had again made the MBT obsolete.

However, this is far from the case since, as the Ukraine and Gaza conflicts have demonstrated, tanks remain a cornerstone of modern warfare.

Lieutenant General Simon Stuart, Australia’s Chief of Army, said of MBTs: “They’re an essential component of land operations and will continue to be in the future. Having tanks as part of a credible combined arms fighting system means that we’re relevant.

“Relevancy is a key component when it comes to generating strategic effects: shape, deter and respond,” Stuart said.

Indeed, the Australian Army put its money where its mouth is, ordering 75 M1A2 SEPv3 Abrams tanks, receiving the first four vehicles in November 2024.

Abrams evolution

Australia’s trajectory echoes what many countries do – upgrade existing tank fleets. Industry OEM General Dynamics Land Systems (GDLS) continues to spirally modernise the Abrams, with US Army M1A2 SEPv3 tanks to undergo modifications like a Mounted Family of Computer Systems tablet, Improved Turret Stabilisation System, XM1147 Advanced Multipurpose 120mm rounds and a Trophy-ready survivability package so Rafael’s active protection system (APS) can be easily retrofitted.

There are no other current or emerging technologies... that can deliver the capability currently provided by an MBT

Australian DoD spokesperson

An Australian Department of Defence spokesperson told Global Defence Technology that MBTs were critical for the Australian Army to secure and control strategic land positions and provide protection.

“There are no other current or emerging technologies – or combination of technologies – that can deliver the capability currently provided by an MBT,” the spokesperson said.

Furthermore, the US Army signalled in September 2023 a new lighter and more survivable Abrams M1E3 variant. Its “fifth generation” capabilities are expected to include: a hybrid electric drive; integrated APS; autoloader and new gun; advanced munitions (e.g. gun-launched antitank missiles); improved command, control and networking; application of artificial intelligence (AI); teaming with robotic vehicles; and masking to reduce thermal and electromagnetic signatures on the battlefield.

The Australian Army has received its first batch of M1A2 SEPv3 Abrams tanks, as the country modernises its fleet with the latest variant. Credit: ADF

GDLS was awarded an M1E3 preliminary design contract on 31 May 2024. Expected to weigh less than 60 tons, this Abrams will form the core of the US Army’s tank fleet from 2040 onwards. GDLS gave an indication of what its future design might look like when it unveiled the AbramsX in 2022.

Asia innovates

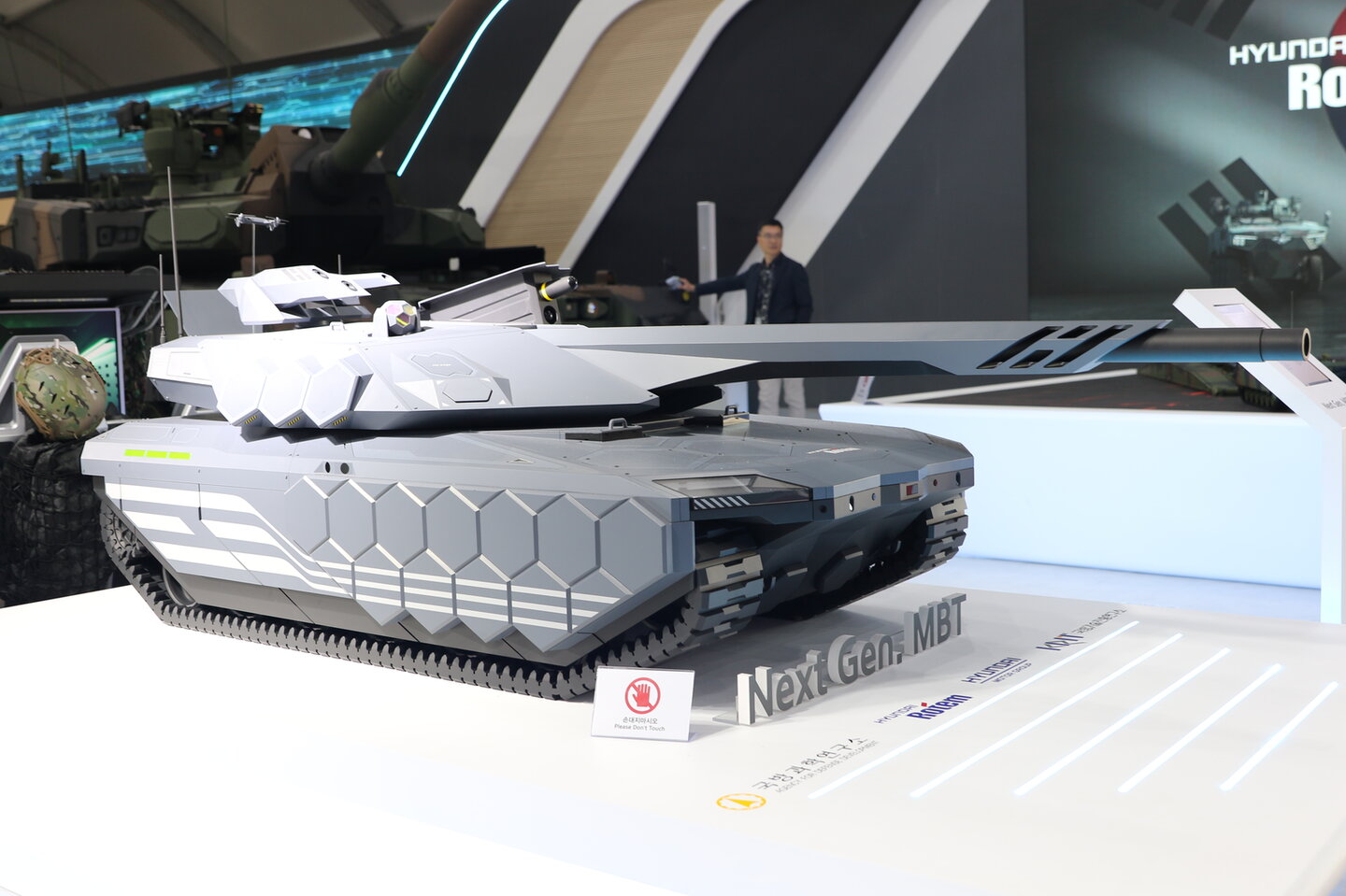

South Korea’s tank production currently focuses on the Hyundai Rotem K2. However, Seoul is already eyeing its future tank platform and, at Seoul ADEX 2023, Hyundai Rotem displayed an indicative scale model of its Next-Generation MBT (NG MBT).

This design provided hints at the direction future MBTs will take worldwide. Tom Kim, Hyundai Rotem’s manager of Global Defence Sales & Marketing Team, told Global Defence Technology that one of the NG MBT’s three crewmembers could operate a second tank through a combination of crewed-uncrewed teaming.

At Seoul ADEX 2023, Hyundai Rotem displayed this indicative scale model of what its Next-Generation Main Battle Tank might look like. Credit: Gordon Arthur

As well as a 130mm smoothbore main gun, the 55-tonne NG MBT features a remote-controlled weapon station (RWS) on the turret roof, antitank missiles in a retractable launcher, plus an integrated APS. Also installed on the turret is a counter-unmanned aerial vehicle system, plus its own UAV for independent reconnaissance. It has better preemptive strike capabilities thanks to an AI-based fire control system.

Kim explained that propulsion would initially come from a diesel-electric hybrid unit, though hydrogen fuel cells are the ultimate goal. Hyundai Rotem said the tank features both explosive reactive armour and ceramic composite armour. Although still the stuff of imagination, Hyundai Rotem believes its NG MBT could enter production around 2040.

European demand

European demand for MBTs remains strong, especially after Russia’s invasion of Ukraine in 2022, although the Leopard 2 is Western Europe’s only in-production MBT.

The continent’s leading (heavy armoured) light is KNDS, formed from Krauss-Maffei Wegmann and Nexter. KNDS has shown various MBT concepts in recent years, even as France and Germany contemplate the future Main Ground Combat System (MGCS) to replace Leclercs and Leopard 2s respectively. The state-of-the-art MCGS is due to fructify around 2045.

KNDS France unveiled the Enhanced Main Battle Tank (EMBT) with ADT 140 turret at Eurosatory 2024, and it can be regarded as a demonstrator for MGCS technology. Comprising a Leopard 2 hull with a new turret and crew compartment where three crew members are ensconced, it features a Nexter 140mm Ascalon main gun with an autoloader, due to the 140mm rounds being too heavy for manual handling.

There is also a coaxial 20mm gun, plus a secondary 30mm cannon in a Nexter ARX 30 RWS. Its fire control system has high levels of automation for detection, identification, prioritisation of targets and cueing of the most suitable weapon.

With the addition of the Prometeus hard-kill APS, the EMBT-ADT 140 represents what future MBTs may well look like – uncrewed turrets, larger guns with autoloaders, and integrated and layered protection systems.

KNDS exhibited a Leclerc Evolution main battle tank concept armed with an Ascalon 140mm main gun at Eurosatory earlier this year. Credit: KNDS

KNDS is also developing the Leopard 2 A-RC 3.0 and Leclerc Evolution as intermediate solutions between existing MBTs and the future MGCS. The Leopard 2 A-RC 3.0 again has an uncrewed turret, which does not penetrate the hull. Three crew, who rely wholly on synthetic vision/cameras, sit in a hull citadel, with each crew station able to cover every role to ensure redundancy.

The design features a 130mm L/51 main gun, which Rheinmetall has been maturing since it was unveiled in 2015; it reportedly has 50% better penetration compared to 120mm guns. There is a 30mm cannon in an RWS and a launcher at the turret rear for missiles/loitering munitions.

Interestingly, designers are including such missile/UAV capabilities on future tanks rather than relying on accompanying specialist vehicles.

As for the Leclerc Evolution showcased at Eurosatory 2024, it combines a refurbished Leclerc hull with an EMBT turret, 120mm (upgradable to 140mm) Ascalon gun and ARX 30 RWS. This is a four person tank, up from the three crew of the Leclerc. There is a launcher at the rear of the turret, and the Leclerc Evolution represents a proposition for overhauling existing Leclerc fleets.

Rheinmetall’s KF51-U demonstrator, also unveiled at Eurosatory 2024, is an evolution of the KF51 Panther. It features an unmanned turret boasting a 130mm gun and 12.7mm coaxial machine gun; significantly, this turret could be retrofitted onto existing Leopard 2 hulls. The KF51-U has a layered protection system containing MUSS 2.0 and ROSY soft-kill obscuration systems, plus Elbit Systems’ hard-kill Iron Fist.

Incidentally, in June 2024, Rheinmetall and Leonardo decided to work together on a new MBT for the Italian Army, to be ready within three years. The KF51 will presumably form the basis of the new MBT to replace Italy’s Ariete fleet, and some 132 new tanks are required.

Lighter options

Deviating from the recent trend towards ever-heavier tanks, there is current renewed international interest in medium and light tanks. China, for example, produces the 36-tonne ZTQ15/VT5, and has already sold it to Bangladesh.

Elsewhere, India unveiled a Zorawar light tank prototype on 6 July 2024, with nimbler vehicles required to defend the mountainous border with China. Featuring a Cockerill 3105 turret, Safran Paseo sights and a foreign engine, the first Zorawar will not be ready until at least 2027. The Indian Army has ordered 59 tanks, but it needs something like 315.

Illustrating the growing popularity of lighter tanks possessing reduced logistical footprints, this is the M10 Booker the US Army is procuring. Credit: GDLS

Indonesia inducted its first Harimau medium tanks on 28 February, these based on the Turkish FNSS Kaplan MT platform. An initial Harimau production contract, signed in April 2019, covered 18 tanks armed with a 105mm gun in a Cockerill CMI-3105HP turret.

Underlining this contemporary desire for lighter tanks, a $322m low-rate initial production contract awarded to GDLS in August 2024 paved the way for the US Army to introduce its first new light tank into its inventory in decades.

Armed with a 105mm main gun, the M10 Booker was selected to meet the Mobile Protected Firepower requirement in 2022 and by leveraging mature Abrams and ASCOD components, the Booker’s development has been accelerated.

The M10, with a crew of four, should weigh less than 40 tonnes to allow two to be transported in a C-17 aircraft. A decision on full-rate production is expected in Q3 of FY2025, with the US Army eventually needing up to 504 vehicles.

Tech trends, new threats

The above programmes illustrate future directions in tank design. Certainly, uncrewed turrets are here to stay, granting significant weight savings, especially as contemporary MBTs have been gradually climbing in mass.

However, an autoloader becomes indispensable for uncrewed turrets, and new elements such as missile/UAV launchers and APS can add weight back on. It is common also for existing hulls to be reused. Indeed, why change or redesign tank hulls when no new technologies are radically improving them right now?

No army can expect to prevail on today’s battlefield without APS installed on its tanks.

Rafael spokesperson

However, that may start to change once novel propulsion solutions become viable. Renk revealed its ATREX hybrid transmission this year, for example, but full electrification is not viable for MBTs using today’s existing technologies.

Another clear observation is that the 120mm-calibre gun is at the end of its development path, with a range of more powerful main guns in development. It may be that 130mm becomes the new standard.

One certainty is that hard-kill APS will become a staple, though their expense may restrict widespread application in cash-strapped militaries.

Trophy and Iron Fist APS have proven themselves in Israeli service. Rafael claims 1,700+ Trophy orders so far, with a spokesperson explaining to Global Defence Technology that the ongoing conflicts in Ukraine and Gaza “clearly demonstrate” that APS is a game-changer for armoured vehicles, enabling them to perform critical missions while manoeuvring in dense, urban, hostile environments.

The first Germany Army Leopard 2 MBT fitted with the Trophy APS was handed over this year. Credit: Rafael

“No army can expect to prevail on today’s battlefield without APS installed on its tanks,” the Rafael spokesperson added.

However, Rafael also acknowledged that APS must adapt to evolving threats like loitering munitions.

Caption. Credit:

Phillip Day. Credit: Scotgold Resources

Total annual production

Australia could be one of the main beneficiaries of this dramatic increase in demand, where private companies and local governments alike are eager to expand the country’s nascent rare earths production. In 2021, Australia produced the fourth-most rare earths in the world. It’s total annual production of 19,958 tonnes remains significantly less than the mammoth 152,407 tonnes produced by China, but a dramatic improvement over the 1,995 tonnes produced domestically in 2011.

The dominance of China in the rare earths space has also encouraged other countries, notably the US, to look further afield for rare earth deposits to diversify their supply of the increasingly vital minerals. With the US eager to ringfence rare earth production within its allies as part of the Inflation Reduction Act, including potentially allowing the Department of Defense to invest in Australian rare earths, there could be an unexpected windfall for Australian rare earths producers.