Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 7 July

The total number of Covid-19 vaccine doses administered has now surpassed the total number of confirmed cases. China leads in the total number of vaccinations.

Covid-19 has already affected our lives forever. The way we work, shop, eat, seek medical advice, socialise, participate in sport, and entertain ourselves will all be different. all industries must plan ahead for multiple eventualities.

2.9 billion

The total single vaccine doses administered.

4.1 million

The number of Brazilians who have not returned for a second dose.

Global real GDP growth

% change on previous year

2.6%

-3.7%

5.4%

Pre-Covid-19 2020 forecast

Adjusted 2020 forecast

2021 consensus

forecast

The cost of Covid-19

$375bn

Estimated monthly cost of the Covid-19 pandemic globally

$11tn

Cumulative loss for global economy over the next two years

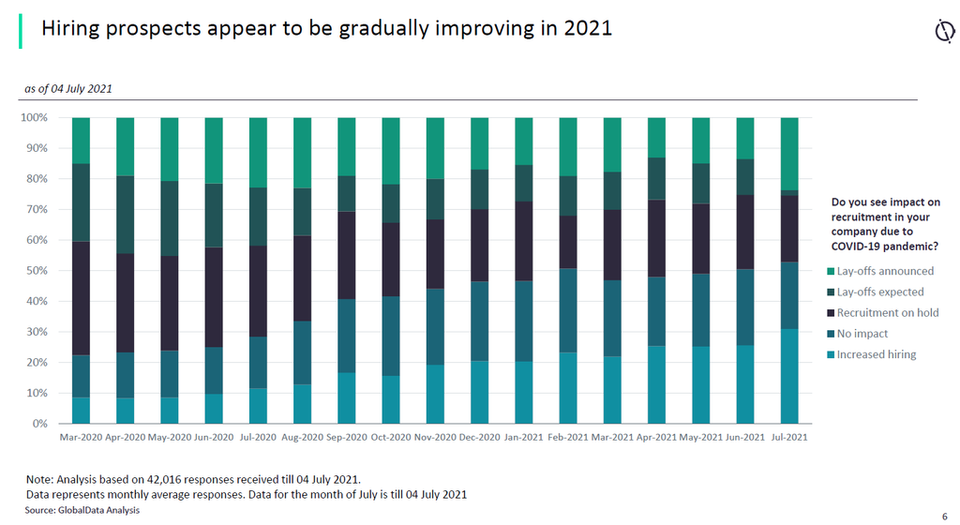

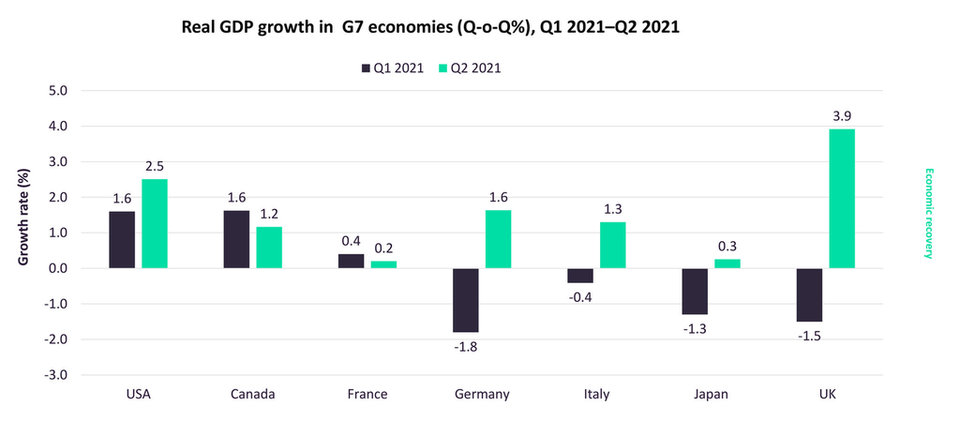

- The road to economic recovery -

The global economy is forecast to return to pre-crisis levels by the end of 2021 or early 2022.

The global economy is projected to grow at record speed in 2021, but the outlook is uncertain and will depend on the effectiveness and distribution of the vaccines and on continued fiscal and monetary support. Recovery will be uneven across countries, sectors, and income levels.

China was the only major economy to achieve positive GDP growth in 2020. Covid-19 related exports led the economic recovery. In 2021, China is expected to account for 27% of global economic growth - more than twice as much as the US.

- SECTOR IMPACT: Aerospace, defence and security -

Defence markets, although relatively shielded from both immediate demand and supply-side shocks, are looking vulnerable in many parts of the world as national debates are ignited around fiscal priorities.

However, countries with large domestic capacity are using defence as a stimulus measure and to offset impact in related aerospace markets. Both the US & UK defence markets have seen significant uplift as a result.

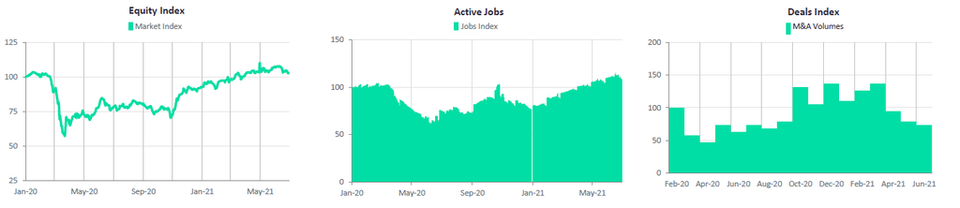

Sector indices

A complex and interdependent relationship between the aerospace and defence markets spreads the pain. Targeted government aid to support sovereign capability will be instrumental in these sectors

Sub-sector impact

Revenue predictions

Credit: L3Harris