- ECONOMIC IMPACT -

Latest update: 11 May 2020

Many economists have cut their GDP forecasts for 2020. The consensus forecast for GDP growth is currently -2.3%

The International Labour Organization estimates 6.7% of worldwide working hours will disappear in Q2 2020, equivalent to 195 million workers

3%

The IMF forecasts the global economy to contract by 3% in 2020

7.5%

The EC predicts the EU economy will contract by 7.5% in 2020, but expects a recovery in 2021

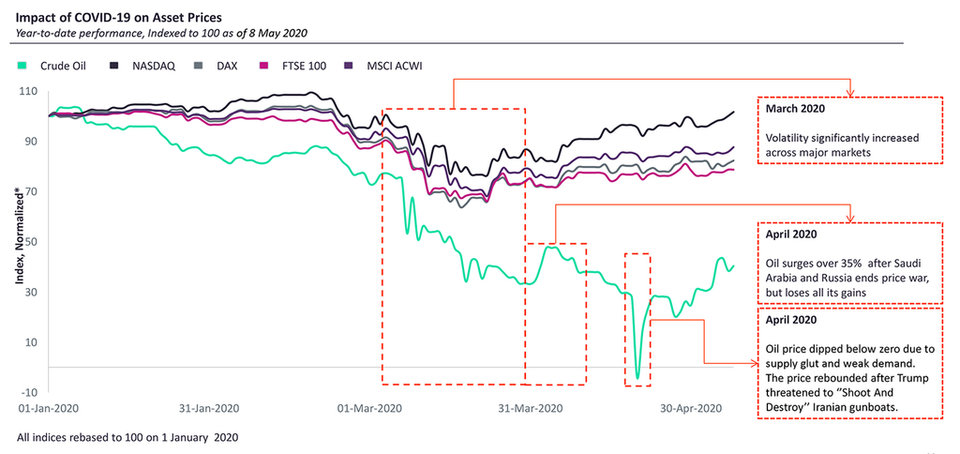

Impact of Covid-19 on asset prices

- SECTOR IMPACT: Aerospace, defence & security -

Latest update: 11 May 2020

$1bn

Revenue predictions

Boeing & Airbus lost $641m and $522m respectively. Both have cut output between 35 to 50%.

Defense prospects are relatively brighter but may be curtailed by medium term fiscal restraint as a result of measures to combat Covid-19, with differing impacts per subsector and per region. Defense is likely to be used as a stimulus in markets with large domestic capacity.

Unemployment

Boeing announces plans to lay off 10% of its workforce following Q1 results, while Airbus furloughs thousands of workers in the UK. Reports suggest Rolls-Royce could shed upwards of 8,000 jobs, 15% of its global workforce.

Defence has yet to be majorly impacted. Strategic capabilities will be protected, as they are extremely difficult to resurrect in short order once lost. A small number of pureplay defense primes, notably Lockheed Martin, have added to headcount recently

Supply chain & demand disruption

The US DoD expects three-month delays on major defence acquisition programs (MDAPs). It also notes specific vulnerability within aerospace, shipbuilding and small space launch markets.

Although South Korea & Thailand have both recently announced defence budget cuts to address Covid-19, these savings are currently attributed to deferred programs and payments, not cancellations.

Sector-specific stimulus programmes

Largest so far is the US CARES act, providing $17bn in specific funding for businesses critical to national security, along with $61bn in aviation and broader aerospace support.

Governments are also implementing prompt payment measures to their defence supply chains with a particular focus on supporting SMEs and identifying weak points, specifically on civil aerospace exposure.

Response to supply chain concerns

The US Department of Defense has initiated steps to keep cash flowing, specifically via the acceleration of payments through prime contracts and expediting payments to subcontractors. The Australian Department of Defense and UK Ministry of Defence have also instigated similar measures to support their own supply chains.

value chain impact of Covid-19