Feature

Artillery is back in vogue

The three-year-long Ukraine-Russia war has propelled artillery demand, but drone warfare could yet supercede indirect fires. Richard Thomas reports.

The Ukraine-Russia war has proven the role of artillery. Credit: UK MoD / Crown copyright

Depending on your source and capability definition, the use of artillery in war was first seen in either 12th Century China, or 14th Century Europe, and for more than a century has been the accepted king of the battlefield following their use during the two World Wars of the 20th Century.

However, the 2000s, with their focus on Western counterinsurgency operations and permissible airspace, saw artillery take a back seat to air power, as fighters dominated doctrine. Much like the venerable tank, commentators wondered if artillery had had its day.

This perception changed with Russia’s invasion of its neighbour Ukraine, bringing a return to state-on-state conflict in Europe and the massed use of indirect fires across a battlefield that more resembled those of WWI and WWII, as trench systems and grinding operations replaced the notion of manoeuvre warfare.

Russia claimed at one stage to be firing up to 10,000 artillery shells per day, with Ukraine’s forces firing somewhere in the range of 2,000-5,000 over the same period.

The three-year-long Ukraine-Russia war has renewed the role that artillery continues to play in modern conflict, with Western countries providing in excess of 800 systems to Ukrainian forces, according to 2024 analysis by Army Technology, Global Defence Technology’s associated land domain news outlet.

These donated systems have needed to be placed by US and European forces, proven by the current and forecast spending on mobile artillery acquisition, amid a wider global rearmament.

Self-propelled artillery: demand forecast

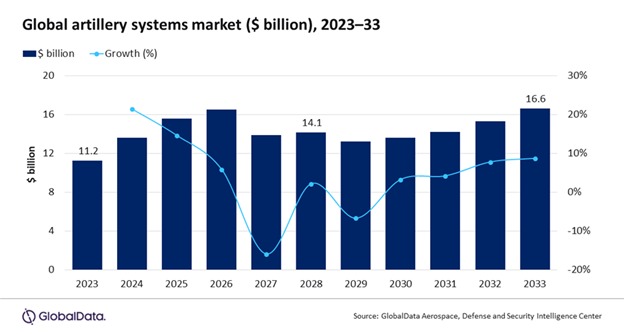

According to GlobalData’s market forecast of the global artillery systems market in 2023, the need to replace or modernise legacy artillery systems would drive worldwide cumulative spending on long-range indirect fires to $153bn between 2023 and 2033, aiding the global market for artillery systems to reach $16.6bn in 2033.

The report detailed the artillery systems market, as it stood then, would grow at a compound annual growth rate of 4.0% between 2023 and 2033. Conventional wars, like in Ukraine, have seen extensive usage of artillery systems, which in turn has led countries to reassess their capabilities and aspire to include more modern artillery systems within their inventory.

One of the most significant individual spenders in the self-propelled market was expected to be the United States, which was forecast to spend a total of $9.7bn in procuring systems like the M109A7 Paladin and next-generation Extended Range Cannon Artillery into the 2030s.

A key advantage of self-propelled system over their towed counterparts is the ability to ‘shoot-and-scoot’, a concept of operations that sees the platform fire off a few rounds before immediately relocating, critical tactics that avoid much of the risk of counter-battery fire.

Slower weapons can help overload air defences, allowing a hypersonic missile to go through and deliver the ‘killing blow’

William Freer, research fellow in national security, Council of Geostrategy

However, it should be noted that this air-launched missile – more accurately considered an aeroballistic missile as it is not strictly ‘hypersonic’, lacking manoeuvrability at excessive speeds – is believed to be one of the least sophisticated weapons in Russia’s hypersonic arsenal.

Speaking to Global Defence Technology, William Freer, research fellow in national security, Council of Geostrategy, provided his assessment of the fledgling Russian Kinzhal:

“Initially it seemed that the Russians had the right idea in targeting Patriot batteries with their Kinzhals… However, it seems the Patriots were able to deal effectively with this threat, so the Russians no longer use them in this manner as far as I am aware,” Freer said.

Even the best laid plans do not survive the battlefield. Therefore, the Kinzhal was repurposed to enhance conventional missile salvos after their inability to penetrate Western air defence technologies on their own, despite Russian President Vladmir Putin’s bombastic praise of the Kinzhal since it was first produced in 2018.

Russian tank losses in Ukraine have been significant,. Credit: Andrii Marushchynets / Shutterstock

Further analysis by GlobalData in 2024 saw the total value of the artillery market reach $11.4bn in 2024 and reach $17.3bn in 2034. This represents a $700m increase from its previous forecast for 2033, at $16.6bn.

The market was forecast to be dominated by the self-propelled artillery segment, accounting for more than 50% of forecast spending. Analysing the figures, and the top five spenders in self-propelled artillery systems offers a considerable surprise with India topping the table by 2034 ($1.1bn), followed by South Korea ($1bn) and, unsurprisingly, Russia ($899m), with China ($818m) and the United States ($738m) in fourth and fifth respectively.

This is despite Europe, as a whole, projected to lead the sector geographically with a share of more than 43%, followed by Asia-Pacific's share slightly in excess of 40%. North America, while individually significant from the United States, will account for under 10% of the total self-propelled artillery market share, indicative of the opportunities in Europe and Asia for industry able to offer turnkey indirect fires solutions.

Risks to the global supply chain

Supply chain disruptions due to the Ukraine-Russia war and sanctions on weapon transfers have compelled a number of countries to develop local manufacturing and maintenance capabilities to reduce their dependence on imports.

In example, India has been inducting indigenously developed Dhanush towed artillery and ATAGS platforms to replace the aging FH77 artillery units in service with the Indian Army since the 1980s. Turkey too has similarly followed suit, focusing on local production where possible, as countries diversify from traditional capability sources.

The move to national industrial capacity also extends to ammunition manufacture, particularly for the mainly 155mm shells used by self-propelled artillery in the West.

Global uncertainty is driving procurement inwards. Credit: Panchenko Vladimir / Shutterstock

GlobalData’s 2024 report, ‘Scaling Rearmament’, revealed the challenges facing countries in Europe and elsewhere in expanding production capacity for high-intensity warfare, as global defence spending was expected to rise to $2.45trn by 2028.

The UK alone has donated hundreds of thousands of artillery shells to Ukraine and signed deals with BAE systems worth £2.4 billion ($3.1 billion) for an eight-fold increase up to 2026, alongside other munitions. Across Europe, firms such as Rheinmetall and KNDS are breaking ground on new production lines.

Some key supply chain chokepoints include machine tools and the labour force itself, with many roles in arms production yet to be replaced by industrial automation.

In addition, a growing global trade war in 2025 could further restrict countries’ ability to rely external sources of materiel and subsystems needed to manufacture and sustain artillery forces.

Will drones take the throne?

However, despite the strong numbers and steady market growth over the coming years, a new capability over the horizon could be set to steal the thunder of the artillery, perhaps for good.

Recently reported by Army Technology, it is understood that the majority of combat casualties in the Ukraine-Russia war are being caused by one-way attack drones, superceding the lethality of artillery.

While the Ukraine war saw the reemergence of artillery and heavy armour as critical battlefield capabilities, once thought obsolete in the face of Western counterinsurgency campaigns, the use of drone warfare at the tactical level has signified a new epoch in modern warfare.

Innovations in doctrine, specialised units, and technological advances, such as fiber-optic guided uncrewed systems, have all contributed to the drone supplanting contemporary military platforms as the prime lethal threat.

Expanding the drone threat to include larger platforms, and the threat multiplies further. It is understood that Russia launched 10,500 glide bombs into Ukraine in March, a massive increase in firing rate from previous years.

Drones are now the most lethal system in the Ukraine war (picture for illustrative purposes only). Credit: Parilov / Shutterstock

With hundreds of tactical attack drones deployed by Ukraine and Russia daily, current understanding states that 70-80% of daily combat losses from both sides are now caused by drones.

Taking Ukraine’s claim on 8 April to have inflicted about 1,300 combat casualties on Russian forces in the preceding 24 hours, drones are likely responsible for more than 1,000 killed and wounded in that single day alone. This peak, albeit from a small sample, is roughly similar to numbers of daily Russian casualties provided by Ukraine’s Ministry of Defence caused during combat operations in the summer of 2024.

It could be that while artillery is still needed, future development will have to incorporate the dangers of drone proliferation across the battlefields, further emphasising the need for mobility over entrenched, static, capabilities.

Dr Al Allsop, Combat Air and Synthetics SME, Inzpire. Credit: Inzpire

The data is gone; you have lost 30 years of insight.

Nick Campion, managing director, VRAI

Caption. Credit:

Total annual production

Australia could be one of the main beneficiaries of this dramatic increase in demand, where private companies and local governments alike are eager to expand the country’s nascent rare earths production. In 2021, Australia produced the fourth-most rare earths in the world. It’s total annual production of 19,958 tonnes remains significantly less than the mammoth 152,407 tonnes produced by China, but a dramatic improvement over the 1,995 tonnes produced domestically in 2011.

The dominance of China in the rare earths space has also encouraged other countries, notably the US, to look further afield for rare earth deposits to diversify their supply of the increasingly vital minerals. With the US eager to ringfence rare earth production within its allies as part of the Inflation Reduction Act, including potentially allowing the Department of Defense to invest in Australian rare earths, there could be an unexpected windfall for Australian rare earths producers.