Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 10 January

According to the OECD, unemployment stood at 5.5% in November 2021 as compared with 5.7% in October 2021. The unemployment rate among G7 nations declined from 4.7% in October 2021 to 4.5% in November 2021.

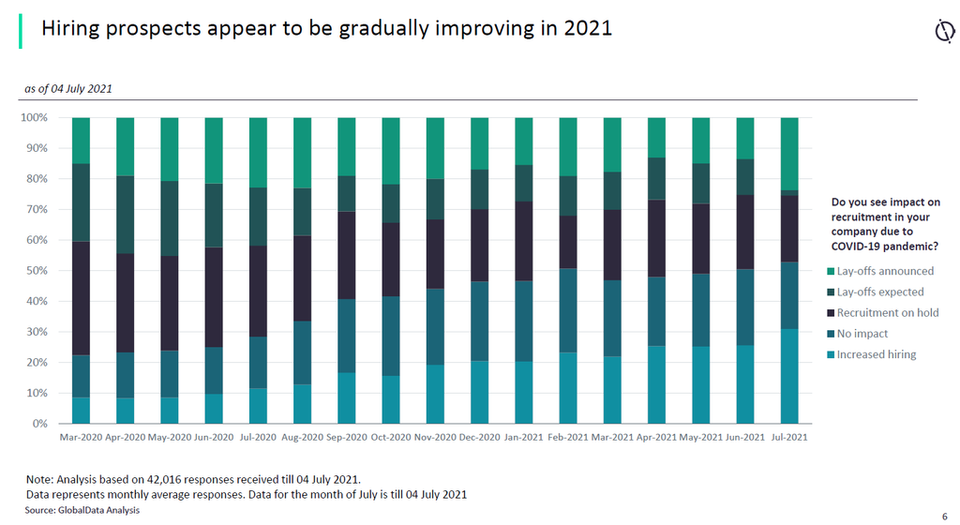

Concern over the spread of Covid-19 remains volatile, so does the business optimism. Hiring prospects continue to improve in 2022. Offices are expected to return to at least 50% capacity in the next three to six months.

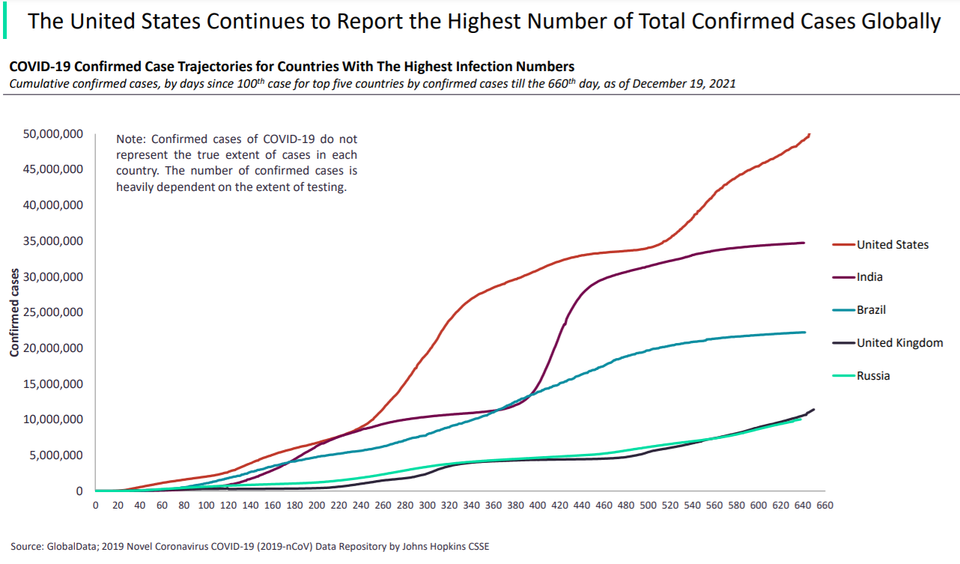

270 million

The virus has now spread to 199 countries with more than 270 million confirmed cases and more than 5.3 million deaths.

4.5%

Positive GDP growth is forecast in all countries; 2022 consensus forecast for global GDP growth is currently 4.5%

Global real GDP growth

% change on previous year

2.6%

-3.7%

5.4%

Pre-Covid-19 2020 forecast

Adjusted 2020 forecast

2021 consensus

forecast

The cost of Covid-19

$375bn

Estimated monthly cost of the Covid-19 pandemic globally

$11tn

Cumulative loss for global economy over the next two years

- IMPACT OF COVID-19 ON EMPLOYMENT OUTLOOK -

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

Sector indices

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

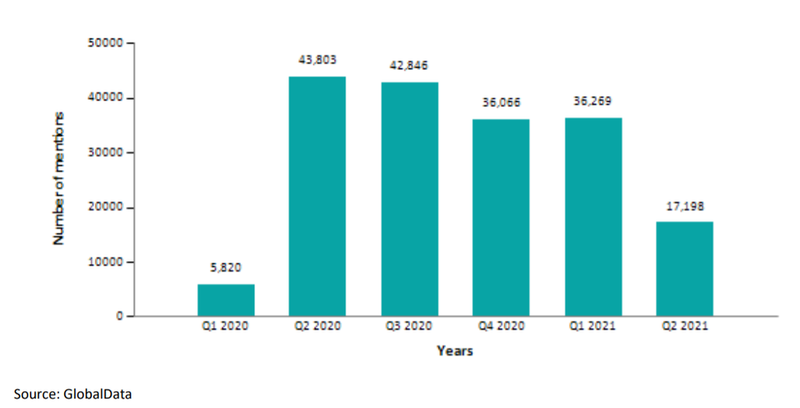

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Last update: 7 January

Airbus now expects commercial aerospace to recover to pre-Covid levels between 2023 and 2025, led by single-aisle extra long-range aircraft. The potential of further lockdowns and travel bans will impact the Primes unevenly, with Boeing having a higher exposure to the faster recovering US domestic market. The Omicron variant is likely to complicate things further, returning to the travel bans of early 2020.

Defence markets, although relatively shielded from both immediate demand and supply-side shocks, are looking vulnerable in many parts of the world as national debates are ignited around fiscal priorities. However, countries with large domestic capacity are using defence as a stimulus measure and to offset impact in related aerospace markets. Both the US & UK defence markets have seen significant uplift as a result.

The future role of the military in supporting civil contingency planning is also under consideration, as is a redefinition of security to implicitly encompass public health and biosecurity aspects. Western supply chain concerns stemming from Chinese-US rivalry have also been exacerbated by Covid-19. This will result in greater FDI scrutiny, multi-sourcing, and onshoring in key areas such as microelectronics

Aerospace, Defence and Security Covid-19 mitigation strategies

Maintenance, repair and overhaul

Massive levels of deferred maintenance and upgrades for airliners. SARS impact suggests Civil MRO will take twice as long to recover as the length of decline in air traffic. Capital constraints may extend the use of existing aircraft, giving a boost in the medium term to aftermarket parts.

Military aerospace

Supply chain disruption from commercial aerospace impact and Covid-19 overall, and possible impact on low TRL-level programmes or legacy support programmes in favour of active production lines as an immediate stimulus measure. Supply chain disruption has potential to resume in face of Omicron, may affect active production lines.

Uncrewed systems

Demand for small form-factor drones has increased, with adjustment of civil aviation restrictions being made to allow for this in many regions. Precedent may result in permanent relaxation of current rules and greater adoption.

Homeland security/soldier systems

Thermal imaging cameras, decontamination systems, deployable medical capabilities and personal protective equipment submarkets are seeing immediate boosts.

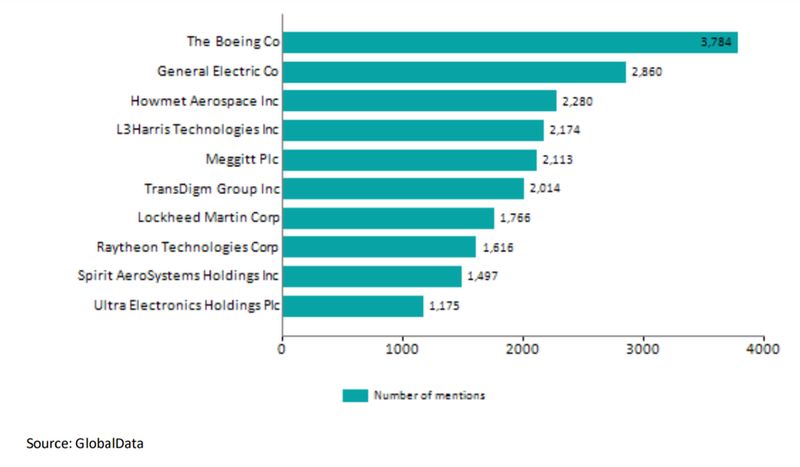

Boeing mentioned Covid-19 more than any other company in the aerospace, defence and security sector during H1 2021.

General Electric held the second position with 2,860 mentions, followed by Howmet Aerospace with 2,280 and L3Harris Technologies with 2,174.

The top ten companies together accounted for 39.8% of total Covid-19-related mentions in the aerospace, defence and security sector.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Covid-19-related mentions in the filings of aerospace, defence and security companies rose to 53,467 in H1 2021 from 49,623 in H1 2020.

During the review period Q1 2020 to Q2 2021, the highest number of Covid-19-related mentions in filings were seen in Q2 2020, while Q1 2020 had the least mentions.

Europe occupied the top spot among geography-related mentions of aerospace, defence and security companies discussing Covid-19, followed by Asia-Pacific, North America, and India between Q1 2020 to Q2 2021.

Sub-sector impact

Revenue predictions

Credit: L3Harris