Ukraine conflict briefing

Powered by

Download GlobalData’s Ukraine conflict executive report

- UKRAINE CRISIS OVERVIEW -

Latest update: 8 June

7 million

Data from the United Nations’ Refugee Agency indicates that around seven million people have crossed the Ukrainian border as of 1 June.

15.7

The UN estimates that at least 15.7 million people inside Ukraine need humanitarian assistance.

Last week saw the sombre milestone of 100 days since Russia invaded Ukraine, with no sign of an end to the conflict. While President Putin initially justified the invasion in part as a response to NATO expansion, the conflict has prompted both Sweden and Finland to join the coalition, strengthening NATO in the face of concerns of further Russian aggression.

There are no signs at this stage of the war fizzling out, even after the probable end of the Donbas campaign this summer. Russia is progressing with its goal of controlling the two south-eastern regions of Ukraine known as the Donbas. Russia will face a strategic decision at this point, whether to switch to a defensive posture or extend Russia’s territorial gains. Both scenarios point to the same outcome: a continuation of the war.

- ECONOMIC IMPACT -

Latest update: 8 June

2.9%

The World Bank has lowered its global growth forecast from 4.1% to 2.9%, with a warning that many countries may see recessions

3.3%

GlobalData forecasts that the world economy will grow at just 3.3% in 2022 following 5.9% growth in 2021.

The conflict continues to create major uncertainties for global food supplies. After a period of easing, prices of grains and oilseeds have begun to escalate again as several other exporting countries have introduced schemes to limit exports and preserve domestic supplies.

Even after a possible end to the conflict, there are significant downside risks to Ukraine’s current 2022/23 grain and oilseed crops, and a lack of supplies such as fertiliser will reduce yields from spring and, most likely, next year’s winter crops.

- IMPACT ON COMMODITY MARKETS -

Latest update: 24 March

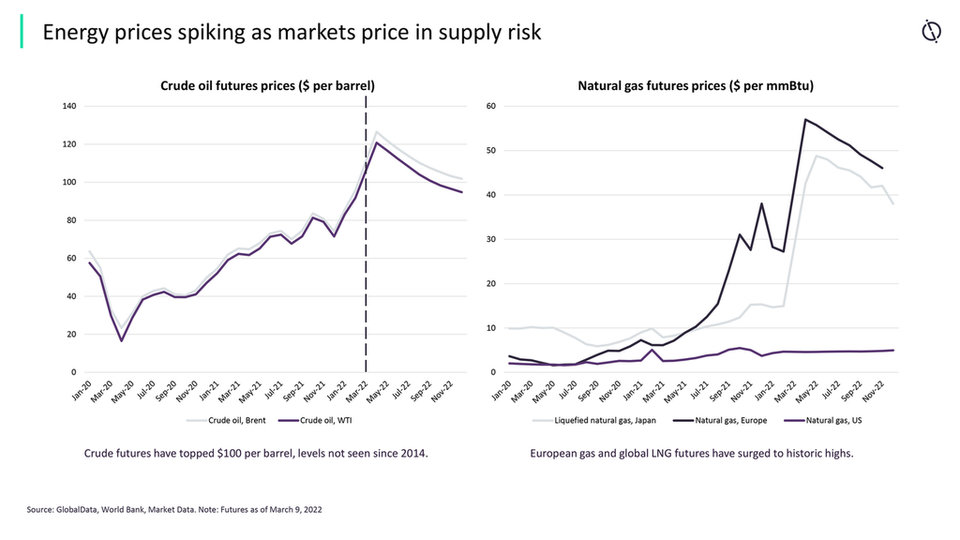

Energy prices spike as markets price in supply risk

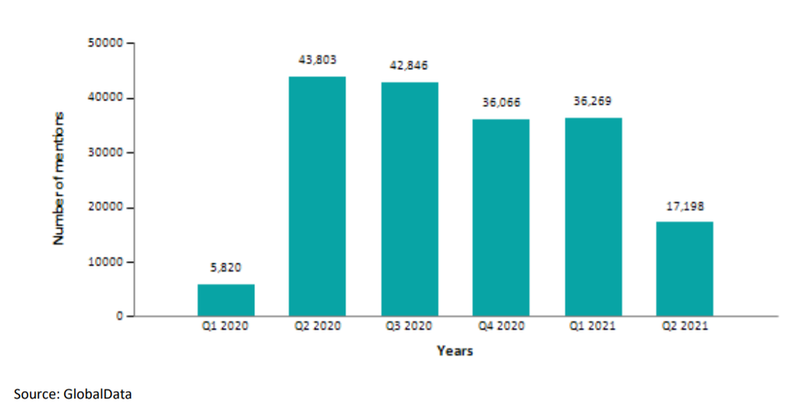

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Latest update: 8 June

Industry predictions

An increase of defence spending closer to the NATO-agreed target of 2% across Europe would result in spending approximately a third higher than current, although it is likely to take some time to ramp up to this level despite political will in many countries.

Historically neutral Finland and Sweden have applied to join NATO, although Turkey is trying to veto this due to its concerns that both nations ostensibly harbour Kurdish terrorists

Western defence companies have seen an increase in orders of relatively cheap, asymmetric self-defence capabilities – notably, anti-tank and anti-aircraft missile systems along with associated ammunition – as nations deplete their own stocks to aid Ukraine. Advanced missile launchers are now also being provided.

Along with Germany's significant €100bn defence spending increase, Poland, Romania, Sweden, Denmark, and China have all announced defence budget increases while France and Canada are considering doing so. However, the UK rules out further spending in the short term due to both fiscal constraint and a rise in defence spending announced during the pandemic, which is deemed sufficient.

Australia, the UK, and the US have announced the collaborative development of hypersonic weapons via the AUKUS pact, countering a perceived Russian lead in this technology. Other areas of weakness that have received limited investment in past decades, such as electronic warfare, are also likely to come into scope.

Supply chain and demand disruption

Although relatively small economies by global standards, Ukraine and Russia are substantial exporters of platinum, aluminium, titanium, nickel, cobalt, lithium, neon, xenon and palladium used in civil and military aerospace and defence electronics. The heavy industries of aerospace and defence will also be impacted by the surge in energy prices more broadly as a result of the conflict.

The conflict risks derailing the fragile aerospace industry recovery since the pandemic. The substantial Ukrainian aerospace industry, one of the largest in the world, faces short-term annihilation.

Impact of sanctions

The ability of the Russian state to finance and develop next generation defence platforms will be hit hard and will impact prospects in growth export markets in the Middle East.

Dependent existing importers of Russian hardware, such as India, stand to be impacted by more stringent application of US CAATSA regulations, likely impacting the S-400 SAM and stealth frigate procurements.

Potential Russian counter-sanctions on titanium would impact the global aerospace industry. Global stockpiles have been bought up and supply constraints past 2023 would have a large impact on production.

Countries such as Finland, Switzerland and Sweden are joining sanction regimes and, in many cases, also providing lethal aid to Ukraine in a step change to their historically neutral positions.