Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 February

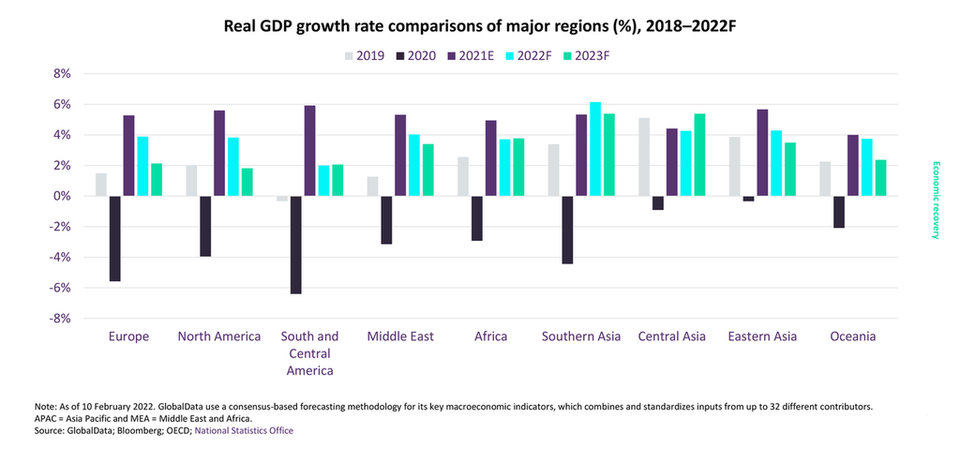

According to the IMF, global economic growth is forecast to slow down to 4.4% in 2022, compared to the 5.9% growth recorded in 2021.

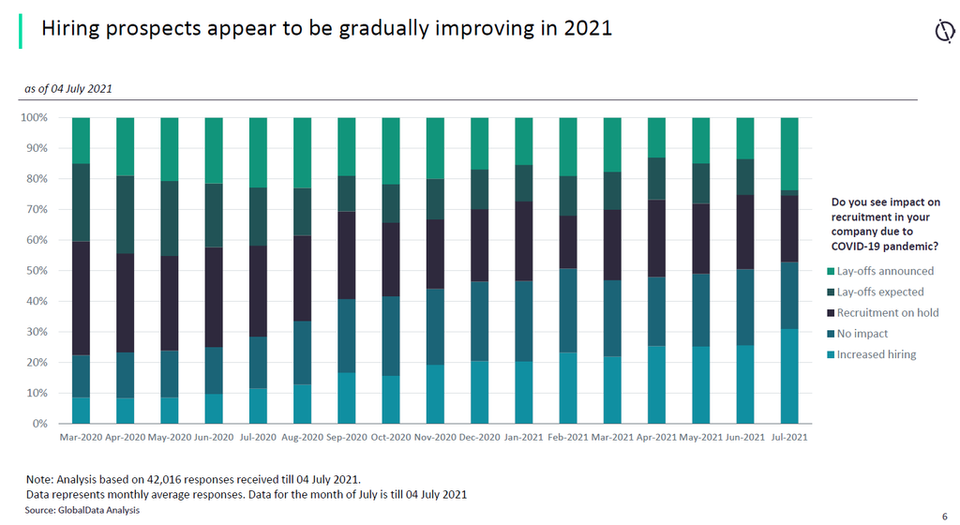

According to the OECD, the unemployment rate in OECD nations stood at 5.4% in December 2021 compared to 5.5% in November 2021.

5.7%

According to the US Department of Commerce, real GDP of the US grew by 5.7% in 2021, the fastest since 1984.

4.4%

Positive GDP growth is forecast in all countries; 2022 consensus forecast for global GDP growth is currently 4.4%.

Global real GDP growth

% change on previous year

2.6%

-3.7%

5.4%

Pre-Covid-19 2020 forecast

Adjusted 2020 forecast

2021 consensus

forecast

The cost of Covid-19

$375bn

Estimated monthly cost of the Covid-19 pandemic globally

$11tn

Cumulative loss for global economy over the next two years

- Global economy recovery -

Global economy to continue recovery in 2022 amid growing imbalances and risks

Sector indices

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

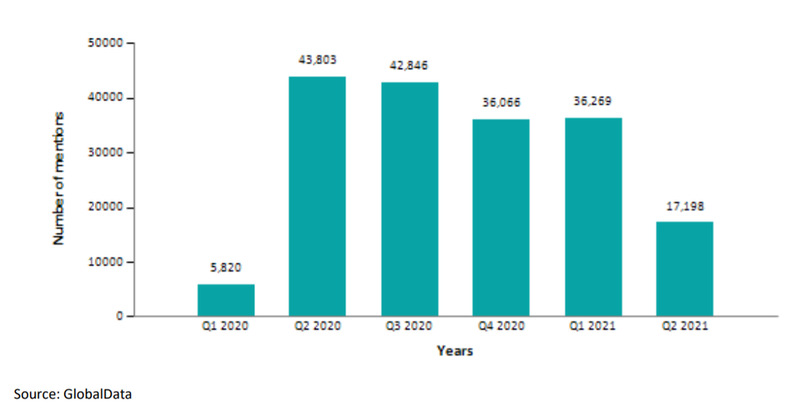

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Last update: 2 February

Military aerospace: moderate negative impact

Supply chain disruption from commercial aerospace impact and Covid-19 overall, and possible impact on low TRL level programmes or legacy support programmes in favour of active production lines as an immediate stimulus measure. Supply chain disruption has potential to resume in face of Omicron, may affect active production lines.

Land platforms: moderate negative impact

Elements of limited exposure to broader automotive industry supply chains but little impact on programs so far. Higher levels of domestic capability across regions compared to naval and aerospace and less regulated supply chains means future readjustment should be easier and quicker.

C4ISR and electronic warfare: moderate positive impact

Military cybersecurity and IT subsectors well positioned in the medium term as a result of demands on distributed working and secure collaboration. Logistic IT specialists also stand to benefit, with new enterprise resource planning software implementations for supply chain tracking.

Uncrewed systems: moderate positive impact

Demand for small form factor drones has increased, with adjustment of civil aviation restrictions being made to allow for this in many regions. Precedent may result in permanent relaxation of current rules and greater adoption.