UK must choose carefully for its Future Medium Helicopter

GlobalData explores the significance of the £1bn contract, which is set to run from 2023 to 2028 and includes crew training, as well as technical support and maintenance.

The Future Medium Helicopter programmeme announced in the 2021 Defence Command Paper, to procure a new medium-lift support and utility helicopter for the RAF and Army, has more than a few factors to consider in its direction.

The £1bn contract is set to run from 2023 to 2028 and includes crew training, as well as technical support and maintenance. It will be a rationalisation of the UK’s medium helicopter fleet from four different airframes into one, aimed at simplifying the logistics chain and enhancing interoperability.

The Westland Puma, Bell’s 212 and 412 models, and Airbus Dauphin are all expected to be replaced by a single new model. Whilst no detailed requirements have been specified yet, it is safe to assume that the mission capabilities currently fulfilled by the four outgoing helicopters must all be retained.

These would include troop transport and logistics, medical evacuation, combat search and rescue, and humanitarian operations. Leonardo, Airbus, Sikorsky, and Bell have all put forward strong platforms, but the decision goes beyond measuring capability- the UK must consider the benefits that its choice can bring to the British economy through involving domestic industry and manufacturing.

More than 70 British companies are already part of the supply chain for the civilian AW149, making a compelling case for domestic industrial benefits.

Leonardo's AW149 is a derivative of a civilian design, offered with an array of mission equipment to fulfil British requirements. The Italian company also offers the benefit of an end-to-end production capability already established in the UK at its plant in Yeovil, meaning its expertise can be quickly put to favourable effect, with a positive stimulus for the British economy.

More than 70 British companies are already part of the supply chain for the civilian AW149, making a compelling case for domestic industrial benefits. Leonardo claims it is already in position to offer a ‘military off-the-shelf’ product within 24 months of signing a contract. The company advertises the potential deal as a key boost to the government’s agenda of post-Covid recovery for the aerospace industry and its defence-industrial strategy.

Airbus’s H175 is likewise a modification of a civilian model but can be readily offered with sufficient military equipment. Like Leonardo’s bid, it will offer production in the UK at a factory in Wales to create British jobs.

Additional savings may also be made with Airbus’s product as it uses avionics systems in common with the Airbus H135 (Juno) and H145 (Jupiter) helicopters, used for training all tri-service helicopter pilots at RAF Shawbury, which should increase spare part availability and ease the training of new pilots. The company also highlights its intention for the UK-built helicopters to become a sustainable export product.

The main draw for the S-70M is its proven service record and the ready availability of spare parts and maintenance equipment due to its wide usage with other militaries.

Sikorsky’s S-70M is an updated version of the popular UH-60 and is compelling as the only bid offering purpose-built for a military role, rather than being adapted from a civilian design. However, it is the only of the three that does not promise a significant role for domestic UK manufacturing. Whilst Sikorsky has suggested the helicopters can be completed in the UK, they would be mostly built in Poland.

The main draw for the S-70M is its proven service record and the ready availability of spare parts and maintenance equipment due to its wide usage with other militaries. Some of these users include key military partners of the UK, such as the US, Poland and Turkey, further enhancing interoperability. This would be a marginal cost-cutting function, as well as an attractive option to the military, who may prefer a reliable off-the-shelf product to avoid the emergent difficulties often encountered in procuring relatively new platforms, and is in keeping with the MOD’s 2020 Integrated review preference for buying off-the-shelf when possible.

Meanwhile, US manufacturer Bell has proposed that the UK wait for its 525 Relentless model to be certified, likely by Q4 2022, as it intends to bid to replace the UK’s fleet. The 525 is yet another civilian design from a well-established company with a history of well-performing products, but it is also an unproven product, and thus far Bell has not pitched any potential British involvement in the production process.

Some of the subcontractors involved in the 525, however, are British. This may lay the groundwork for a domestic production deal, but the path forward is not as clear as it is for Leonardo’s strong pitch to use its established British facilities.

It is unclear what impact the independent procurement will have on Nato’s programmeme, but the UK should keep the interoperability of its chosen helicopters with allied platforms in mind.

Another factor in the decision is NATO's upcoming Next Generation Rotorcraft Capability programme, which is scheduled to begin its concept phase this year. The UK is already an active participant, but its projected delivery date is far off, currently aimed at 2035-40. The UK initiating its own project aimed at completion inside this decade is indicative of the timeliness with which the government wants to procure new helicopters.

It is unclear what impact the independent procurement will have on NATO's programme, but the UK should keep the interoperability of its chosen helicopters with allied platforms in mind. Britain’s choice may even steer decision-making on future rotorcraft across the alliance.

Additionally, the US Army’s Future Vertical Lift programmeme may leave the UK wishing it had waited to see what new medium lift helicopters emerge from the programme, with both Bell and Sikorsky putting forward innovative designs.

The UK’s future rotorcraft fleet will certainly be afforded versatility, but a careful choice must be made on which platform offers the best value for money.

The UK faces a choice over purchasing an off-the-shelf yet well-proven model in the S-70M, or newer adaptations of civilian designs that may produce a better result for British industry through cooperation and domestic production to stimulate the economy.

Current offerings on the rotorcraft market sport capabilities that suit the requirements and are also future-proofed with open-architecture software that simplify future upgrades and enhance interoperability with allied forces. The UK’s future rotorcraft fleet will certainly be afforded versatility, but a careful choice must be made on which platform offers the best value for money and has a positive impact on the British aerospace industry, which has suffered during the pandemic.

GlobalData currently puts the global rotorcraft markets value at $25.6bn, and it would be wise for the UK to solidify a continued role in the market. Saving taxpayers’ money with off-the-shelf designs may be appealing in the short term, but the potential for Leonardo’s or Airbus’s helicopters to boost the government’s post-Covid ‘Build Back Better’ strategy arguably makes them the more attractive options.

Hybrid vehicles as first stage of development

There is currently a focus on the development of hybrid vehicles for use in the armed forces before fully electric vehicles are used. The US and UK armies have independently commissioned the development of hybrid vehicles.

The US Army awarded the University of Wisconsin a contract to research how hybrid powertrains can be integrated into the fleet. Furthermore, the electric light reconnaissance vehicle being explored by the US Army will likely be initially equipped with a hybrid system before moving to full electrification.

The same can be said for the UK’s Protected Mobility Engineering & Technical Support (PMETS) programme to electrify the MAN SV, Jackal and Foxhound vehicles. BAE Systems is also heavily focusing on producing hybrid vehicles including heavy-duty trucks, and buses.

The reasoning behind the development of hybrid vehicles before full electrification is that it means that some of the benefits of EVs can be gained before some of the hurdles of full electrification are overcome.

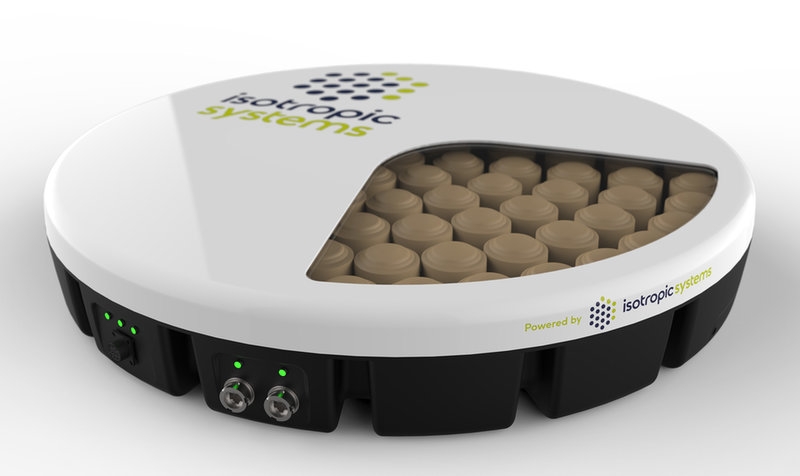

// Isotropic Systems’ multi-beam terminal meshes signals from multiple satellites

// Main image credit: PhotoStock10 / Shutterstock.com.

Comment