NSI Act 2021 will not slow US acquisition of UK defence firms

The UK Government must balance neoliberal principles and appeasing a pro-British business voter base. GlobalData associate defence analyst Madeline Wild investigates.

There has been a recent spate of acquisitions of major UK defence companies by US firms. Notable examples include Cobham’s sale to Advent International in 2020 and the acquisition of Meggitt by Parker Hannifin. These deals all have high values, both in terms of deal price and in terms of what the intellectual and information ownership that the UK defence industry will lose.

Adapting the acquisition model

At a time of national uncertainty and strain as the UK tries to rebuild after Covid-19 and Brexit, any hits to the industry resulting from loss of business ownership will be keenly felt. The National Security and Investment Act (NSI Act) that was introduced this year aims to safeguard UK industry against potentially malicious foreign investment.

However, because the US is a close ally and shares sensitive information with relative freedom, the NSI Act will likely do little more than slow down the acquisition process. Both the acquisition of Meggitt and Ultra Electronic, which were initiated after the introduction of the NSI Act, have been referred for further investigation by the UK Government.

This was to counteract the threat of possible malicious investment from foreign entities looking to acquire UK defence company’s intellectual property for their own gain, which in turn could then be used against the UK. In the past, the neoliberal policies of the UK have meant that foreign direct investment (FDI) screening is less rigorous than its European counterparts, however, increased FDI scrutiny will change this.

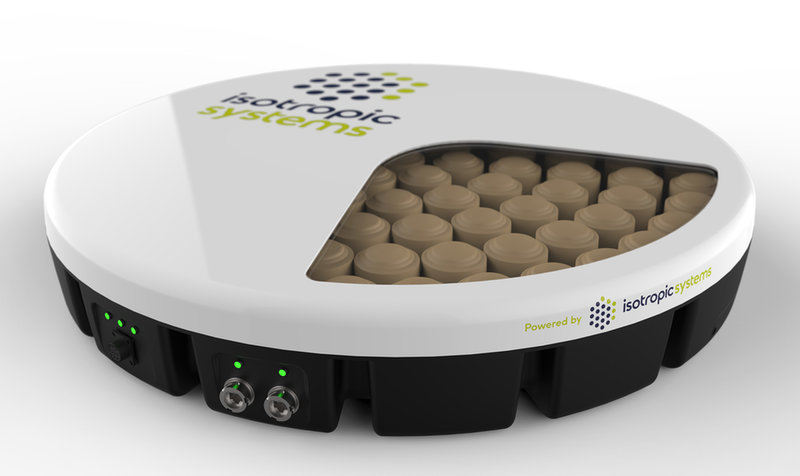

// Isotropic Systems’ multi-beam terminal meshes signals from multiple satellites

The more of these satellite systems that go up, the more it creates the demand for an antenna that can connect to more than one at a time without compromising performance.

Global Britain

Several factors have facilitated the uptick in US acquisition of UK companies in the defence sector as well as in other industries. Firstly, the price of the stock has been relatively cheap this year owing to Covid-19 and post-Brexit financial struggles and secondly, current government policies have encouraged foreign investment into the UK.

The slogan ‘Global Britain’ represents the idea being pushed by Boris Johnson's government that the UK is ‘open for business’. Subsequently, investment into the UK, be it through merger and acquisition (M&A) practices or other means, is being actively encouraged, at the expense of UK-owned industry.

This is at odds with the UK’s European neighbours, where having partial ownership by the state is common. Large European defence companies such as Thales, Hensoldt and Nammo all have some form of state ownership.

The recent flurry of M&A activity in the defence industry has been subject to investigation thanks to the NSI Act, demonstrating the fine line the government walks between upholding their neoliberal FDI principles, whilst appeasing its voters who would rather promote British-owned business first.

// Main image: Investment in the UK is being actively encouraged, at the expense of UK-owned industry. Credit: Shutterstock.

Business