Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 18 August

After months of decline, GDP estimates for many countries have turned positive: the consensus forecast for world GDP growth in 2021 is 6.1%.

Polls show that technology will change job prospects over the next three years, with AI expected to bring a change to job prospects.

2.3%

China’s real GDP is forecasted to expand by 2.3% over the previous quarter in Q3 2021.

6.4%

The unemployment rate in OECD nations stood at 6.4% in June 2021, down from 6.5% in May 2021.

Global real GDP growth

% change on previous year

2.6%

-3.7%

5.4%

Pre-Covid-19 2020 forecast

Adjusted 2020 forecast

2021 consensus

forecast

The cost of Covid-19

$375bn

Estimated monthly cost of the Covid-19 pandemic globally

$11tn

Cumulative loss for global economy over the next two years

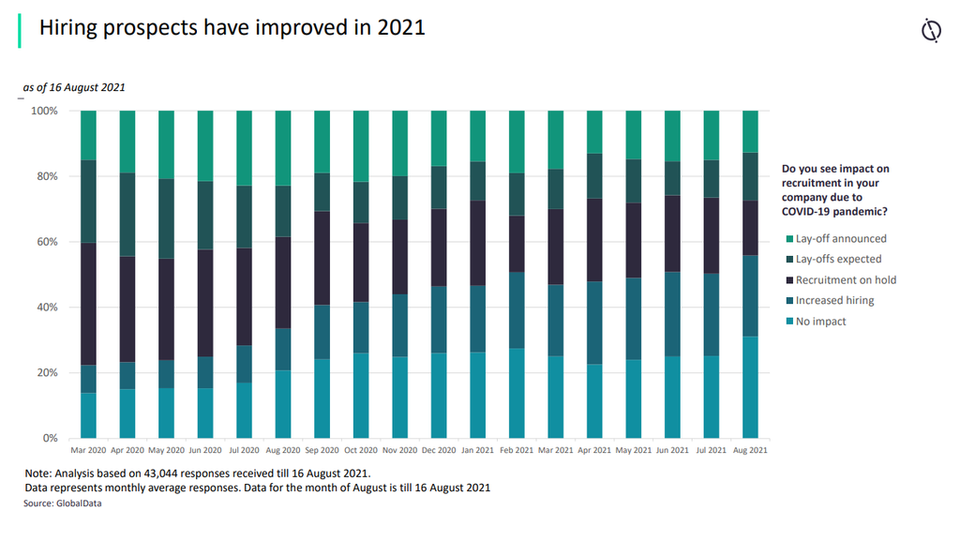

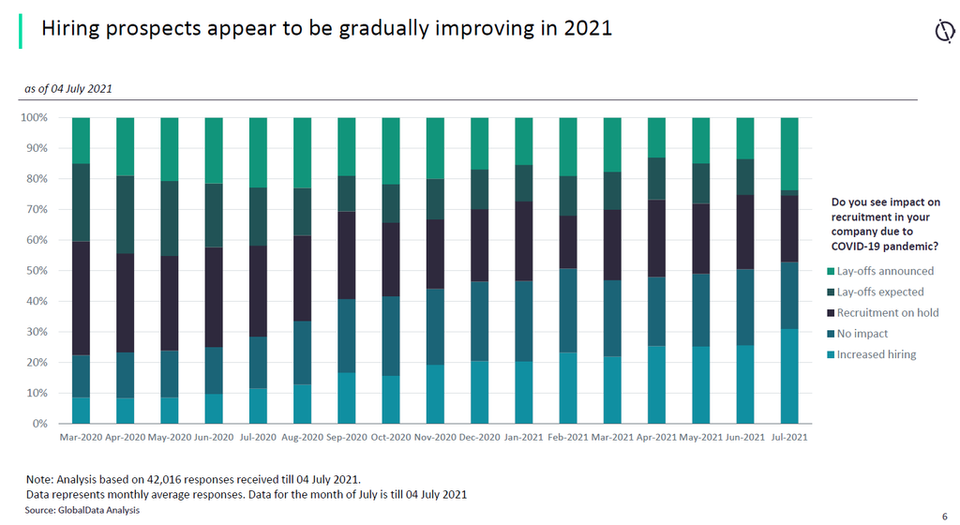

- IMPACT OF COVID-19 ON EMPLOYMENT OUTLOOK -

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

Sector indices

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

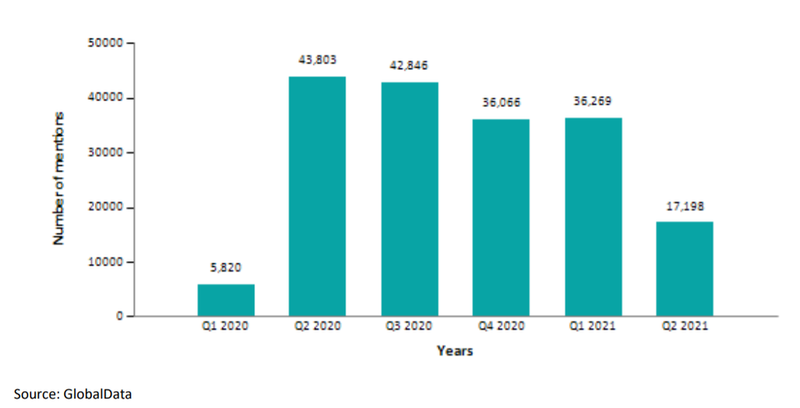

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Last update: 3 September

Military aerospace is seeing supply chain disruption from commercial aerospace impact and COVID-19 overall, and possible impact on low TRL-level programmes or legacy support programmes in favour of active production lines as an immediate stimulus measure.

Land platforms have limited exposure to broader automotive industry supply chains but there has been little impact on programs so far. Higher levels of domestic capability across regions compared with naval and aerospace and less regulated supply chains mean future readjustment should be easier and quicker

Military cybersecurity and IT subsectors well positioned in the medium term as a result of demands on distributed working and secure collaboration. Logistic IT specialists also stand to benefit, with new enterprise resource planning (ERP) implementations for supply chain tracking.

Aerospace, Defence and Security Covid-19 mitigation strategies

Short and mid-term strategies: one to three years

Mitigate supply chain risks, start long-term movements away from single sourcing where possible, full financial and commercial audits of supply chain and ERP refresh.

Position for aftermarket parts boost to extend service life of older models as well as long term draw-down in wide-body demand, particularly if oil price still depressed.

For defence primes, future budgetary impact should be extant by this point, allowing positioning to occur.

Long-term strategies three to five years

Expect higher levels of long-term government involvement and state ownership in key areas.

Prepare for future overproduction caused by government support to aerospace pulling forward demand.

Confront rebooted defence-industrial policies – a broader definition of strategic industry may emerge. Governments will pick winners in this crisis and may get used to it.

Address regional and subsector variation in defence austerity.

Expect increased localised production demand for export orders.

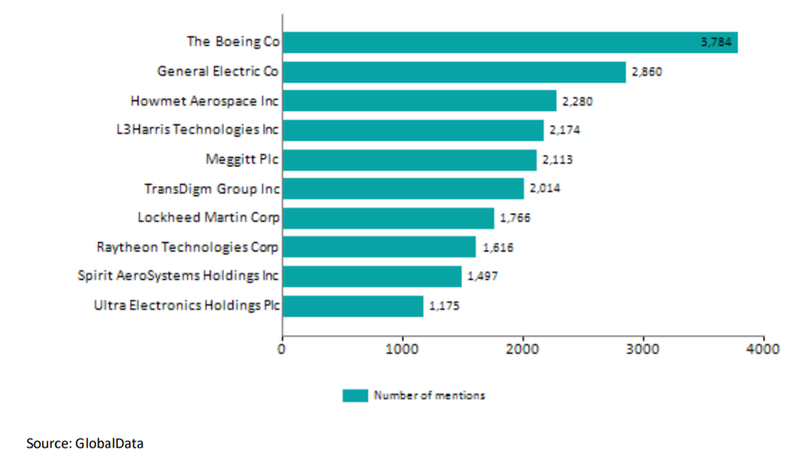

Boeing mentioned Covid-19 more than any other company in the aerospace, defence and security sector during H1 2021.

General Electric held the second position with 2,860 mentions, followed by Howmet Aerospace with 2,280 and L3Harris Technologies with 2,174.

The top ten companies together accounted for 39.8% of total Covid-19-related mentions in the aerospace, defence and security sector.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Covid-19-related mentions in the filings of aerospace, defence and security companies rose to 53,467 in H1 2021 from 49,623 in H1 2020.

During the review period Q1 2020 to Q2 2021, the highest number of Covid-19-related mentions in filings were seen in Q2 2020, while Q1 2020 had the least mentions.

Europe occupied the top spot among geography-related mentions of aerospace, defence and security companies discussing Covid-19, followed by Asia-Pacific, North America, and India between Q1 2020 to Q2 2021.

Sub-sector impact

Revenue predictions

Credit: L3Harris