Ukraine conflict briefing

Powered by

Download GlobalData’s Ukraine conflict executive report

- UKRAINE CRISIS OVERVIEW -

Latest update: 24 March

3.5 million

According to the United Nations’ Refugee Agency (UNHCR), at least 3.5 million people have fled Ukraine as of March 22.

6.5 million

The latest information from the UNHCR also shows that some 6.5 million Ukrainians have been displaced internally.

Sanctions on Russian banks, companies, government officials and prominent individuals continue to grow. Both the US and the UK announced bans on Russian energy imports. Certain G7 countries such as Canada have already withdrawn Russia’s trade benefits through executive action, but in other countries this may require legislative action.

The invasion of Ukraine has triggered a surge in energy and commodity prices, driving downgrades in the growth outlook for many major economies. The outlook for the conflict and broader geopolitical tensions remains the key source of uncertainty for the global economy, with discussions increasingly shifting from reflation to stagflation.

- ECONOMIC IMPACT -

Latest update: 24 March

3.6%

GlobalData forecasts that the world economy will grow at a slower pace of 3.6% in 2022, following a 5.9% growth in 2021.

5.8%

The global inflation rate is projected to rise to 5.8% in 2022, from 3.5% in 2021 due to supply chain disruption amid the Ukraine-Russia war.

2022 real GDP growth forecast by region

Asia-Pacific: 4.3%

Middle East and Africa: 3.9%

North America: 3.5%

West Europe: 3.4%

Africa: 3.4%

Latin America: 1.9%

East Europe: -1.6%

2022 real GDP growth forecast by country

Ukraine: -10.1%

Russia: -10.6%

US: 3.4%

Canada: 3.9%

India: 7.6%

China: 4.5%

- IMPACT ON COMMODITY MARKETS -

Latest update: 24 March

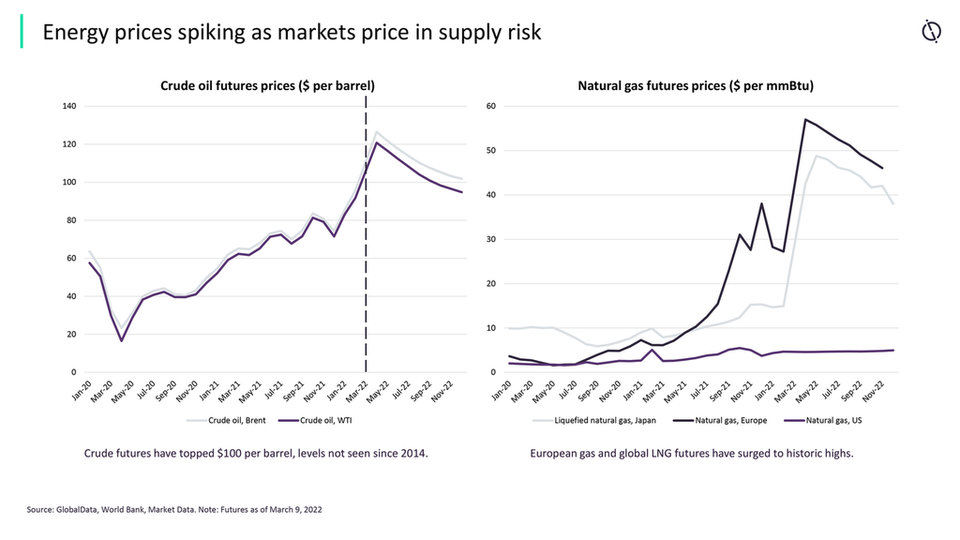

Energy prices spike as markets price in supply risk

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Latest update: 24 March

Industry predictions

An increase of defence spending closer to the Nato-agreed target of 2% across Europe would result in spending of about a third more than at present, although it may take some time to ramp up to this level. The additional Nato goal of 20% of spend directed towards R&D efforts is less likely to be achieved in the short term as budget increases will be targeted at immediate capabilities rather than pipeline development.

Western defence companies are expected to see an immediate increase in orders of relatively cheap, asymmetric self-defence capabilities. Notably, anti-tank and anti-aircraft missile systems along with associated ammunition as nations deplete their own stocks to aid Ukraine.

Germany, the perennial under-spender in European defence, has committed to spend at least 2% of its GDP, with an additional €100bn fund created to improve military equipment immediately with the purchase of F-35 aircraft and Israeli drones.

Poland, Romania, Sweden, Denmark and China have also announced defence budget increases while the UK, France and Canada are considering increases in the near future.

The conflict risks derailing the fragile aerospace industry recovery since the pandemic. The substantial Ukrainian aerospace industry, one of the largest in the world, faces short term annihilation.

Supply chain & demand disruption

Although relatively small economies by global standards, Ukraine and Russia are substantial exporters of platinum, aluminium, titanium, nickel, cobalt, lithium, neon, xenon and palladium, which are all used in civil and military aerospace and defence electronics.

The heavy industries of aerospace and defence will also be impacted by the surge in energy prices more broadly as a result of the conflict.

Impact of sanctions

Russia's ability to finance and develop next-generation defence platforms will be hit hard and will impact prospects in growth export markets in the Middle East.

Dependent importers of Russian hardware such as India could be impacted by more stringent application of US CAATSA regulations, likely impacting the S-400 SAM and stealth frigate procurements.

Potential Russian counter sanctions on titanium would impact the global aerospace industry. Global stockpiles have been bought up and supply constraints past 2023 would have a large impact on production.

Countries such as Finland, Switzerland and Sweden are joining sanction regimes and, in many cases, also providing lethal aid to Ukraine in a step change to their historically neutral positions.