Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 2 August

Vaccination continues to create economic optimism. In the UK, a successful vaccination roll-out has led to the lifting of almost all restrictions. However, the world has not seen off the pandemic. Questions remain on to which extent immunity created by the vaccine in the community is sufficient to avoid a third wave.

Singapore leads the ranking as the economy best placed for recovery. Its externally oriented economy and equity market have been boosted by other countries reopening their economies. Canada makes the biggest leap in the ranking buoyed by reopening and a successful vaccination effort.

6%

Consensus forecast for world GDP, up from 4.9%

2.8 billion

Single doses of Covid-19 vaccine administered.

Global real GDP growth

% change on previous year

2.6%

-3.7%

5.4%

Pre-Covid-19 2020 forecast

Adjusted 2020 forecast

2021 consensus

forecast

The cost of Covid-19

$375bn

Estimated monthly cost of the Covid-19 pandemic globally

$11tn

Cumulative loss for global economy over the next two years

Sector indices

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- Sector indices -

The global economy is forecast to return to pre-crisis levels by the end of 2021 or early 2022.

The global economy is projected to grow at record speed in 2021, but the outlook is uncertain and will depend on the effectiveness and distribution of the vaccines and on continued fiscal and monetary support. Recovery will be uneven across countries, sectors, and income levels.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Covid-19-related mentions in the filings of aerospace, defence and security companies rose to 53,467 in H1 2021 from 49,623 in H1 2020.

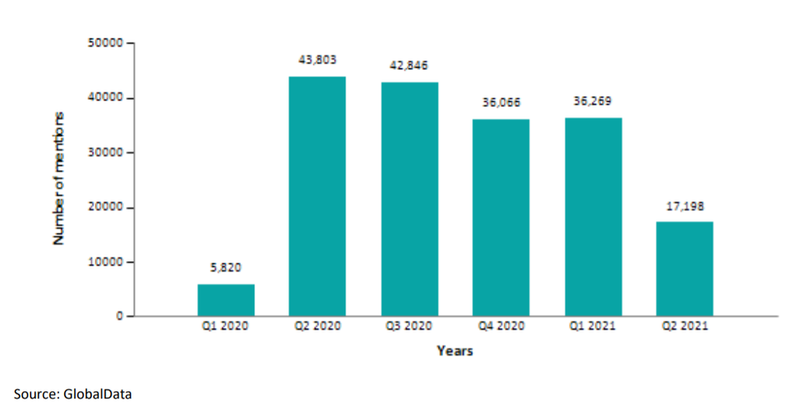

During the review period Q1 2020 to Q2 2021, the highest number of Covid-19-related mentions in filings were seen in Q2 2020, while Q1 2020 had the least mentions.

Europe occupied the top spot among geography-related mentions of aerospace, defence and security companies discussing Covid-19, followed by Asia-Pacific, North America, and India between Q1 2020 to Q2 2021.

COVID-19-related mentions in the filings of aerospace, defence and security companies rose to 53,467 in H1 2021 from 49,623 in H1 2020.

During the review period Q1 2020 to Q2 2021, the highest number of COVID-19-related mentions in filings were seen in Q2 2020, while Q1 2020 had the least mentions.

Europe occupied the top spot among geography-related mentions of aerospace, defence and security companies discussing COVID-19, followed by Asia-Pacific, North America, and India between Q1 2020 to Q2 2021.

However, countries with large domestic capacity are using defence as a stimulus measure and to offset impact in related aerospace markets. Both the US & UK defence markets have seen significant uplift as a result.

Most mentions of Covid-19 in filings

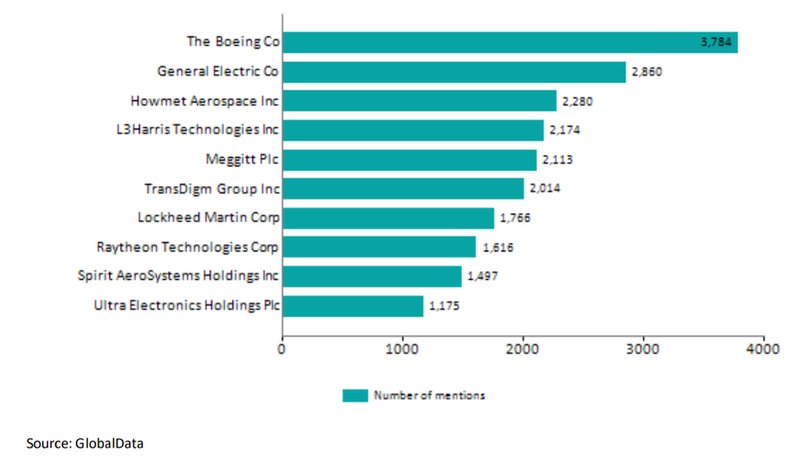

Boeing mentioned Covid-19 more than any other company in the aerospace, defence and security sector during H1 2021.

General Electric held the second position with 2,860 mentions, followed by Howmet Aerospace with 2,280 and L3Harris Technologies with 2,174.

The top ten companies together accounted for 39.8% of total Covid-19-related mentions in the aerospace, defence and security sector.

Sub-sector impact

Revenue predictions

Credit: L3Harris