Ukraine conflict briefing

Powered by

Download GlobalData’s Ukraine conflict executive report

- ECONOMIC IMPACT -

Latest update: 5 December

4 months

The Ukrainian authorities have requested a four-month Program Monitoring with Board Involvement (PMB) to support their economic programme.

25%

A quarter of Ukraine’s population is projected to be living in poverty by the end of the year.

The initiation of the PMB programme would pave the way for a fully-fledged support effort by the International Monetary Fund (IMF). Ukraine’s economic activity is expected to stabilise in 2023, according to the IMF, with growth at 1% under the baseline scenario, although inflation is expected to remain elevated at around 25% on average.

According to World Bank figures a quarter of Ukraine’s population will be living in poverty by the end of 2022, up from just 2% prior to the invasion of the country by Russia. Ukraine’s economy is predicted to contract by 35% this year following destruction to production capacity damage to agricultural land, and reduced labour forces with more than 14 million people displaced as a result of Russia invasion.

- UKRAINE CRISIS OVERVIEW -

Latest update: 5 December

$500m

The World Bank announced another round of funding to help Ukraine meet needs created by Russia’s invasion.

$17.8bn

Since February 2022, the World Bank has mobilised around $17.8bn in financial support to Ukraine, of which about $11.4bn has been disbursed, as of 22 November, 2022.

The World Bank announced on 24 October the disbursement of an additional $500m to help Ukraine meet urgent spending needs created by the Russian invasion. The IBRD financing is supported by $500m in loan guarantees from the United Kingdom, announced 30 September, 2022, and was mobilised under the Public Expenditures for Administrative Capacity Endurance in Ukraine (PEACE) Project, which supports continued government capacity, including the provision of core public services such as health, education, pensions and social protection.

The international community has continued to provide financial support to Ukraine throughout the invasion of its territory by Russia. This includes funding provided through a range of mechanisms, including via the Bilateral Grant Financing to Multi Donor Trust Fund from the US ($1bn), the UK ($92m), Norway ($31m), Austria ($11m), Denmark ($22m), Latvia ($5.5m), Lithuania ($5.5m), and Iceland ($1m).

- IMPACT ON COMMODITY MARKETS -

Latest update: 24 March

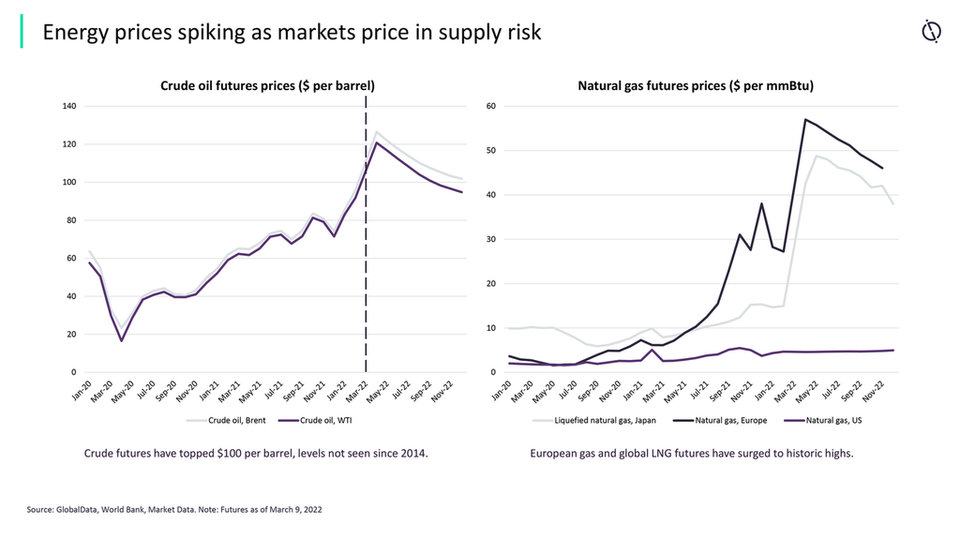

Energy prices spike as markets price in supply risk

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Latest update: 5 December

Supply chain and demand disruption

Although relatively small economies by global standards, Ukraine and Russia are substantial exporters of platinum, aluminium, titanium, nickel, cobalt, lithium, neon, xenon and palladium used in civil and military aerospace and defence electronics.

Defence OEMs continue to speak of the difficulties experienced in the global supply chain, with the Ukraine war exacerbating the fallout from the Covid-19 pandemic. However, donations of equipment by NATO states to Ukraine is expected to create opportunity for international defence companies.

Impact of sanctions

The European Commission reported that the Russian economy would contract by between 3.4%-5.5% this year and continue to shrink in 2023 by between 2.3%-4.5%. Earlier forecasts suggested a Russian GDP drop of 11% in 2022.

Estimations from the IMF, World Bank and OECD show that Russia’s inflation rate will increase sharply by the end of 2022, reaching almost 14%. Forecasts for 2023 vary from 5% (IMF) to 6.8% (OECD). The war and sanctions have also had a significant impact on Russian companies. Since February, Moscow Exchange’s main index has fallen by more than one third.

However, high oil prices and Russia’s leverage of its status as an energy exporter have negated some of the financial fallout, with countries such as India and China willing to increase energy imports from Russia, with the two countries representing around 50% of Moscow’s crude oil export market.

Industry predictions

While NATO member governments have been quick to speak of the need to boost defence spending to counter to threat of Russia, pressing national priorities and economic issues have impacted the ability for countries to immediately increase spending.

The US has committed more than $21.8bn in security security assistance to Ukraine since 2014, and more than $19bn since the beginning of Russia's 24 February invasion. A recent 23 November announcement of further support to Ukraine listed a $400m security assistance package drawn from Department of Defense equipment that included 10,000 120mm mortar rounds, and over 20 million rounds of small arms ammunition.

The applications of Finland and Sweden to join NATO have been ratified by 28 of its 30 member states. However, Hungarian Prime Minister Viktor Orbán has said that Hungary would not seek to ratify the applications until 2023 amid reports that he is seeking to gain concessions from the European Union prior to any agreement.

Turkey is also withholding ratification of Finland and Sweden’s accession to NATO, with any agreement conditional on security and diplomatic concessions regarding the Kurdish diaspora resident in the two countries.