Ukraine conflict briefing

Powered by

Download GlobalData’s Ukraine conflict executive report

- ECONOMIC IMPACT -

Latest update: 2 February

1.9%

Despite some more positive recent indicators, most major economies are expected to see growth slowdown or experience outright recessions in 2023.

0.1%

The forecast contraction of the Eurozone market for 2023, down from a previous figure of 0.6%, due to lower levels of inflations.

GlobalData forecasts that the world economy will grow at a slower pace of 1.9% in 2023 following a 3.1% growth in 2022 and 5.9% growth in 2021. On the other hand, the global inflation rate is projected to ease in 2023 but stay at elevated levels. Global inflation is forecast at 5% in 2023 as compared to 8.4% in 2022 and 3.5% in 2021.

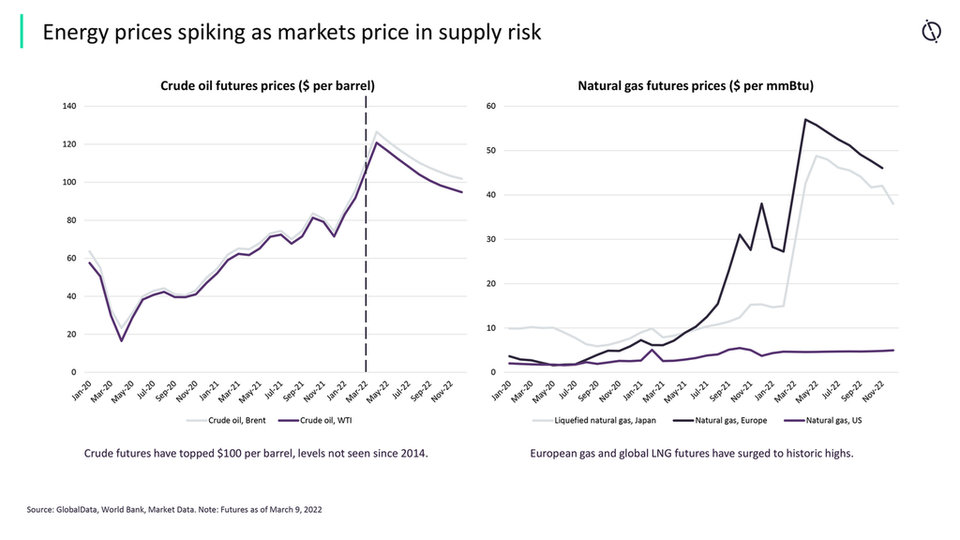

According to GlobalData’s Ukraine Conflict Executive Briefing, one positive for the European economy has been the unseasonably warm winter, which has reduced energy demand and seen gas prices fall to their lowest level since the Russian invasion of Ukraine. This is already feeding through to lower inflation and may contribute to a more positive outlook for Europe than had previously been forecast.

- UKRAINE CRISIS OVERVIEW -

Updated: 2 February

12 months

Nearly one year on since Moscow’s invasion of Ukraine on 24 February 2022, the war has entered a period of stagnation with neither side gaining the initiative.

$17.8bn

Since February 2022, the World Bank has mobilised around $17.8bn in financial support to Ukraine, of which about $11.4bn has been disbursed, as of 22 November, 2022.

Military movement and breakthroughs from in the southeast and east of Ukraine has slowed, with front line becoming more static and conflict attritional. Military casualties, meaning personnel killed, injured or otherwise incapacitated on operations, for both Ukraine and Russia likely pass 100,000, although it is thought that Moscow’s forces have sustained a higher ratio of personnel killed in action.

The international community has continued to provide financial support to Ukraine throughout the invasion of its territory by Russia. This includes funding provided through a range of mechanisms, including via the Bilateral Grant Financing to Multi Donor Trust Fund from the US ($1bn), the UK ($92m), Norway ($31m), Austria ($11m), Denmark ($22m), Latvia ($5.5m), Lithuania ($5.5m), and Iceland ($1m).

- IMPACT ON COMMODITY MARKETS -

Latest update: 24 March

Energy prices spike as markets price in supply risk

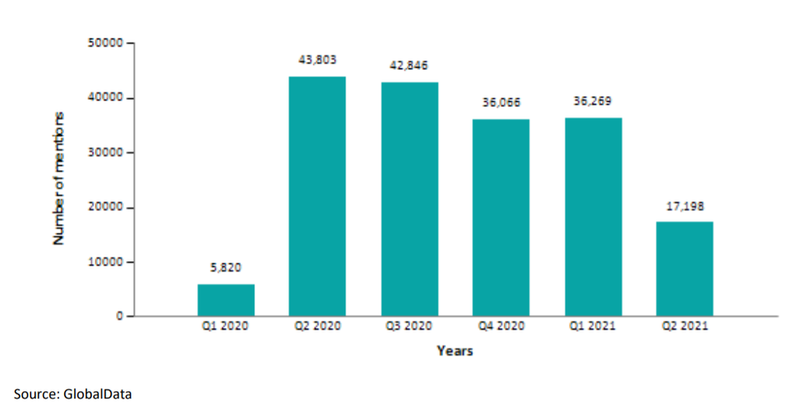

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Latest update: 2 February

Supply chain and demand disruption

Although relatively small economies by global standards, Ukraine and Russia are substantial exporters of platinum, aluminum, titanium, nickel, cobalt, lithium, neon, xenon and palladium utilized in civil and military aerospace and defence electronics. Aerospace giants are still struggling to ease themselves off Russian titanium.

Western countries are facing a problem of diminishing war stocks. The transfer of arms to Ukraine has left nations with an ever-depleting supply of munitions, with the industry unable to restart or improve manufacturing at the rate needed.

Impact of sanctions

The ability of the Russian state to finance and develop next generation defense platforms will be hit hard and will impact prospects in growth export markets in the Middle East. Dependent existing importers of Russian hardware such as India stand to be impacted by more stringent application of US CAATSA regulations, likely impacting the S-400 SAM and stealth frigate procurements.

Potential Russian counter sanctions on titanium would impact the global aerospace industry. Global stockpiles have been bought up and supply constraints past 2023 would have a large impact on production.

Russia is being forced to import weaponry from other sanctioned nations such as Iran and North Korea. Iranian loitering munitions have been deployed to Ukraine, although it is not clear if this is with Russian forces or Russian-backed mercenaries.

Industry predictions

The credibility of the Russian Armed Forces and its equipment has been severely diminished, leading to existing orders with Russian defence firms being cancelled due to sanctions and Russia’s inability to complete orders. The Philippines cancelled an order for 16 Mi-17 helicopters due to diplomatic pressure from the US.

President Vladimir Putin publicly called out his industry minister for Russia’s poor ability to manufacture equipment need for the war.

Under-investment in defence and freeriding on the back of US security guarantees have been perennial complaints leveled at Europe for years, with few nations in the region achieving the NATO agreed target of 2% of GDP. Poland is the notable stand out announcing ambitions to reach 5% of GDP on defence spend, placing a $12bn order for MBTs, self-propelled howitzers and light aircraft with a host of South Korean companies.

While NATO member governments have been quick to speak of the need to boost defence spending to counter to threat of Russia, pressing national priorities and economic issues have impacted the ability for countries to immediately increase spending.