Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 11 October

Covid-19 infection rates remain high. The virus has now spread to over 198 countries with a total of more than 232 million confirmed cases and over 4.7 million deaths.

In the 4-week period up to 26th September, the UK had the highest rate of new cases of the ten most infected countries.

97%

Percentage of US Covid patients admitted who are unvaccinated.

2.9 billion

Global single vaccine does administered.

Global real GDP growth

% change on previous year

2.6%

-3.7%

5.4%

Pre-Covid-19 2020 forecast

Adjusted 2020 forecast

2021 consensus

forecast

The cost of Covid-19

$375bn

Estimated monthly cost of the Covid-19 pandemic globally

$11tn

Cumulative loss for global economy over the next two years

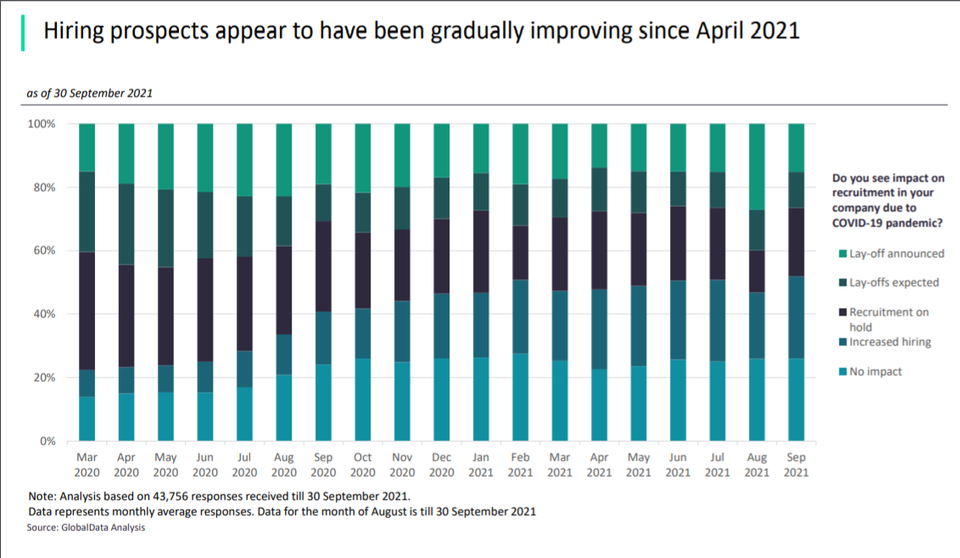

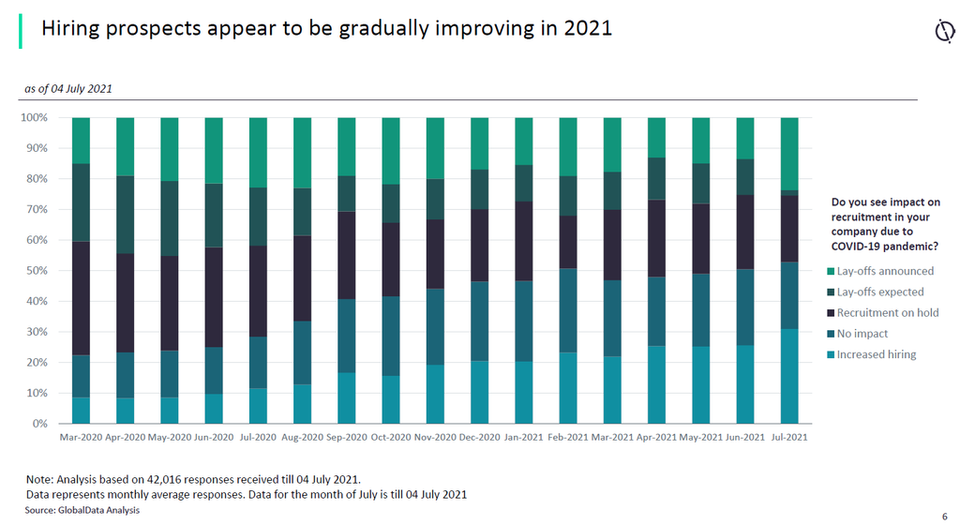

- IMPACT OF COVID-19 ON EMPLOYMENT OUTLOOK -

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

Sector indices

GlobalData analyses company filings and transcripts, uncovering overarching company sentiment and underlying trends hidden in vast amounts of financial and non-financial data.

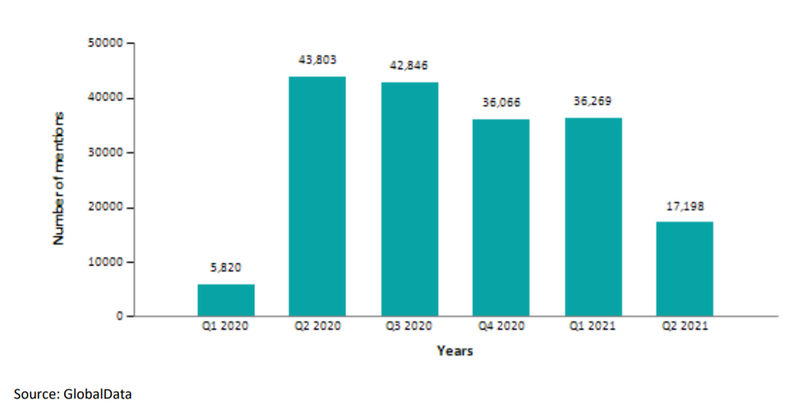

The mentions of COVID-19 in the financial filings of aerospace, defence and security companies grew 7.75% in H1 2021 compared with H1 2020.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Last update: 7 October

Airbus now expects commercial aerospace to recover to pre-Covid levels between 2023 and 2025, led by single-aisle extra long-range aircraft. The potential of further lockdowns and travel bans will impact the primes unevenly, with Boeing having a higher exposure to the faster recovering US domestic market.

Defence markets, although relatively shielded from both immediate demand and supply side shocks, are looking vulnerable in many parts of the world as national debates are ignited around fiscal priorities. However, countries with large domestic capacity are using defence as a stimulus measure and to offset impact in related aerospace markets. Both the US and UK defence markets have seen significant uplift as a result.

The future role of the military in supporting civil contingency planning is also under consideration, as is a redefinition of security to implicitly encompass public health and biosecurity aspects. Western supply chain concerns stemming from Chinese-US rivalry have also been exacerbated by Covid-19. This will result in greater FDI scrutiny, multi-sourcing, and onshoring in key areas such as microelectronics.

Aerospace, Defence and Security Covid-19 mitigation strategies

Short and mid-term strategies: one to three years

Mitigate supply chain risks, start long-term movements away from single sourcing where possible, full financial and commercial audits of supply chain and ERP refresh.

Position for aftermarket parts boost to extend service life of older models as well as long term draw-down in wide-body demand, particularly if oil price still depressed.

For defence primes, future budgetary impact should be extant by this point, allowing positioning to occur.

Long-term strategies three to five years

Expect higher levels of long-term government involvement and state ownership in key areas.

Prepare for future overproduction caused by government support to aerospace pulling forward demand.

Confront rebooted defence-industrial policies – a broader definition of strategic industry may emerge. Governments will pick winners in this crisis and may get used to it.

Address regional and subsector variation in defence austerity.

Expect increased localised production demand for export orders.

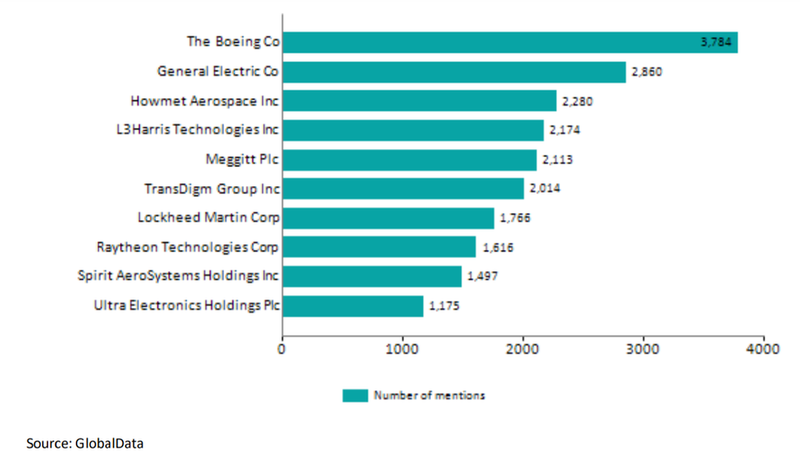

Boeing mentioned Covid-19 more than any other company in the aerospace, defence and security sector during H1 2021.

General Electric held the second position with 2,860 mentions, followed by Howmet Aerospace with 2,280 and L3Harris Technologies with 2,174.

The top ten companies together accounted for 39.8% of total Covid-19-related mentions in the aerospace, defence and security sector.

- SECTOR IMPACT: AEROSPACE, DEFENCE AND SECURITY -

Covid-19-related mentions in the filings of aerospace, defence and security companies rose to 53,467 in H1 2021 from 49,623 in H1 2020.

During the review period Q1 2020 to Q2 2021, the highest number of Covid-19-related mentions in filings were seen in Q2 2020, while Q1 2020 had the least mentions.

Europe occupied the top spot among geography-related mentions of aerospace, defence and security companies discussing Covid-19, followed by Asia-Pacific, North America, and India between Q1 2020 to Q2 2021.

Sub-sector impact

Revenue predictions

Credit: L3Harris