DEALS ANALYSIS

Deals activity drops year-on-year globally

Powered by

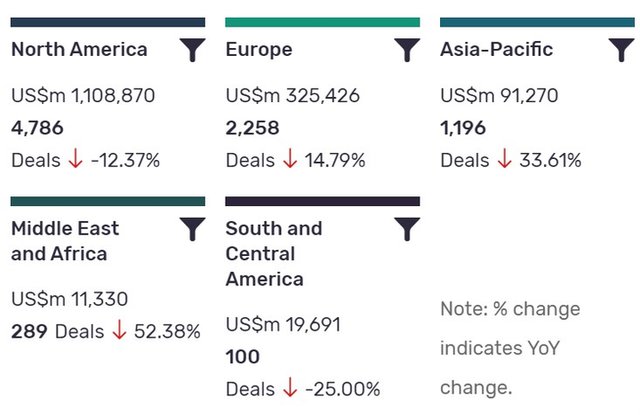

Deals activity by geography

Defence, aerospace and security industry deals, as captured by GlobalData, are down year-on-year (YoY) across all regions, with the Middle East and Africa seeing the biggest drop in deals.

Looking at all types of deals, North America is leading in terms of deal value and volume, but recorded a YoY decline in deals volume at -12.37%. The other regions also saw a significant decline in deals YoY, with deal volumes down -14.79% in Europe, -33.16% in Asia-Pacific and -25% in South and Central America

M&A snapshot: year-on year-change

Analysis of mergers and acquisitions (M&A) completed in the past 12 months, as recorded by GlobalData, shows a -100% drop in mergers YoY in the aerospace, defence and security industries, with a total of 42 recorded. Acquisitions are down 97% YoY with 2,973 deals recorded, while asset transactions are up 1% with 746 deals.

| Deal Type | Total deal value ($m) | Total deal count | YoY change, volume |

| Merger | 19,429 | 42 | -100% |

| Acquisition | 554,798 | 2,963 | -97% |

| Asset transaction | 44,355 | 746 | 1% |

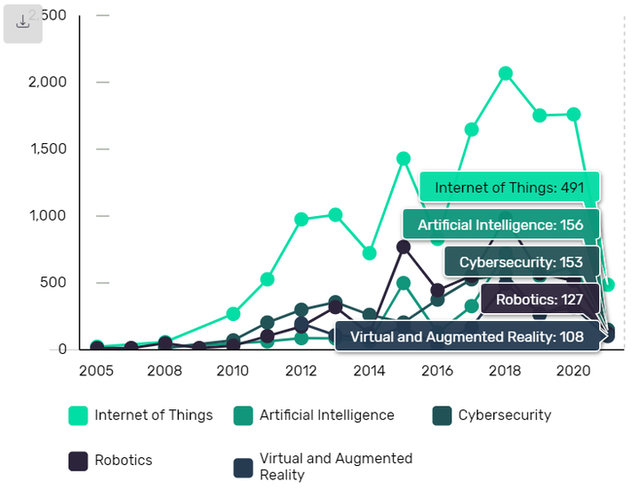

Deals by theme

GlobalData’s analysis of defence industry deals by theme shows that deals related to the internet of things (IoT) are off to a strong start in 2021 with 491 deals recorded so far. Artificial intelligence and cybersecurity are looking strong with 156 and 153 deals recorded in 2021 so far. Robotics and virtual and augmented reality have seen 127 and 108 deals so far, respectively.

In terms of deal value, GlobalData has tracked $30bn worth of IoT-related deals and $29bn worth of cybersecurity-related deals in 2021 so far. AI-related deals stand at $9bn value this year so far, robotics at $8bn, and big data at $3bn.

| Deals value by theme | 2019 | 2020 |

| Internet of things | $101bn | $43.7bn |

| VR and AR | $1.3bn | $34bn |

| Artificial intelligence | $1.48m | $10.7bn |

Note: All numbers as of 14 April 2021. For more insight and data, visit GlobalData's Aerospace, Defense & Security Intelligence Centre.